FHA Debt to Income Ratio Requirements 2024

The debt to income ratio is the most important factor used by lenders to determine a comfortable mortgage payment and loan amount that a borrower can be approved for. The debt to income ratio calculation helps determine the borrower’s ability to repay the loan.

The standard FHA guidelines allow for a DTI of 43%, however much higher ratios of up to 56.9% are allowed with compensating factors. These FHA DTI limits are more flexible than conventional loans.

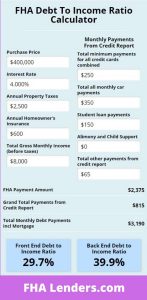

After reading about how the FHA debt to income ratio works, you can use our helpful FHA Debt-to-Income Ratio calculator below to see what your personal DTI is.

What is a Debt to Income Ratio?

The FHA debt-to-income ratio is a measure used by the Federal Housing Administration to determine if borrowers are financially qualified for an FHA loan. This ratio calculates the percentage of a borrower’s monthly income that goes towards paying off debts, including housing expenses.

If you have spoken with a lender they may have talked to you about your debt to income ratio because it is the primary method of determining how much you may qualify for.

The debt to income ratio (DTI) is the percentage when dividing your proposed mortgage payment (plus) your total monthly obligations into the total gross monthly income.

Lenders use a front end DTI and a back end DTI (two calculations) to determine eligibility and both are detailed below.

Click to get a pre-approval with a High Debt to Income Ratio

How to Calculate the FHA Debt to Income Ratio

When calculating the FHA debt to income ratio, you will start with your gross monthly income. Then, you will add up all of the required monthly payments that appear on your credit report. This includes credit card minimum payments, car payments, personal loans, other mortgages, etc. The only exception would be student loans since they are handled differently.

Here is an example of a debt to income ratio calculation. You can also use our debt to income calculator  provided at the end of the article:

provided at the end of the article:

Gross monthly income = $6,200

Monthly Obligations

- Visa minimum payment = $25

- Amex minimum payment = $65

- Car Payment = $275

- Proposed mortgage payment = $1,750 (principal, interest and MIP)

- Proposed monthly property taxes, insurance and HOA fees = $475

Total Monthly Obligations = $2,590

Back End Debt to Income Ratio = $2,590 / $6200 = $41.7%

*Helpful Hints

When shopping for a home, the property taxes will have a significant impact on your DTI calculation and ultimately how much home you will be able to purchase.

In addition to property taxes, if you are shopping for a condo or a home that is part of an association, the association fees must also be included in your DTI.

Click to speak with a loan professional who can help

Understanding FHA Front-End Ratio

The FHA front end debt to income ratio is the calculation of your monthly gross income divided into the proposed mortgage payment, taxes, insurance and MIP. This calculation is for the housing related debt only. FHA guidelines specify the maximum front end ratio will be 31%-40% depending upon the borrower’s credit score.

Housing related debt includes the proposed mortgage payment of principal and interest, the monthly property taxes, monthly homeowners’ insurance, monthly FHA mortgage insurance, and homeowner’s association fees if applicable.

Understanding FHA Back-End DTI Ratio

The back end ratio is essentially your total debt to income ratio. This includes your proposed housing debt plus any additional monthly consumer debt payments that appear on your credit report. This was outlined in the calculation above. It is the back end ratio that will ultimately be the deciding factor on whether your income levels are high enough to qualify for the mortgage you are applying for.

FHA Debt-to-Income Ratio Compensating Factors

FHA manual underwriting guidelines permit lenders to allow for higher DTI ratios if borrowers are able to meet various compensating factors. These additional scenarios help to offset the risk associated with approving mortgages with higher DTI levels. Some of these compensating factors are as follows:

Residual Income – If the borrower has significant funds remaining each month after all expenses are paid, lenders may allow higher debt to income ratios.

Cash Reserves – If the borrower has significant cash reserves on hand after closing in the event of a financial emergency, then this would be another compensating factor. A lender may consider an additional 6 months of mortgage payment reserves to be adequate but not required.

Minimal Payment Shock – Payment shock is when a borrower’s monthly housing payment increases significantly when purchasing a home and going from the prior rent/mortgage payment to the new proposed payment. If the borrower’s payments will remain virtually stable under the new mortgage payment scenario, this will make lenders feel comfortable approving the higher DTI.

High Credit Scores – If your credit scores are high, then you have proven to be financially responsible. This will go a long way in getting approved for a higher DTI. Lenders consider credit scores over 700 to be high.

Steady Employment – Have you been employed for a while at the same place or have you been bouncing from job to job with various gaps in employment over the past few years? Establishing a reliable source of income is going to be important.

With these and other compensating factors, FHA lenders may allow DTI Ratios over 50% and up to 56.9%. In the end, your approval will be up to the analysis and decision of the underwriter. Keep in mind that each lender will have their own qualification requirements and they can decide how high of a DTI threshold they are willing to accept.

FHA Debt to Income Ratio Chart

This chart will indicate what debt-to-income ratio is acceptable based upon your fico score. This chart also outlines some compensating factors that may be needed to qualify for the higher DTI levels. Keep in mind this is just a basic guideline and it would be best to discuss your personal scenario because you still may qualify despite what this chart says.

| Minimum Credit Score | Qualifying Ratios

Front/Back |

Compensating Factors |

| 500-579 or No Credit Score | 31/43 | No compensating factors available with credit scores below 580.

For FHA Energy Efficient Homes, ratios can be increased to 33/45 |

| 580 and above | 31/43 | No compensating factors are required. Back ratio can go up to 45% for Energy Efficient Homes |

| 580 and above | 37/47 | One of the following:

|

| 580 and above | 40/40 | No discretionary debt |

| 580 and above | 40/56.9 | Two of the following:

|

How to lower your DTI to Qualify for an FHA Loan

There are many methods to lower your DTI and the most obvious is to either increase your monthly income or reduce your monthly debt. However, there are some less obvious tips that we will share with you here.

Increase Your Income – If you are self-employed or earn cash or tips in your line of work, then it will be important to be able to document this income when you apply for a mortgage. The mistake others make is not depositing all income including cash or tips into a bank account.

Lenders will need to see the flow of money going into your bank accounts. It does not matter whether you withdraw those funds soon afterwards. Documenting that the cash is coming in is a way to increase your documented gross monthly income which will in turn lower your DTI ratios.

Lower Your Monthly Debt – The DTI ratios are often driven up by large monthly payment requirements. If you are going to pay down debt to help your DTI ratios before applying for a mortgage, you should target the debt that has the largest monthly payment requirement, NOT the debt that has the largest balance.

Negotiate lower homeowner’s insurance premiums – Homeowner’s insurance payments are part of your DTI calculation. Consider speaking with your insurance agent about lowering the annual or monthly premium in exchange for a higher deductible.

The goal is to eliminate any monthly payments from your credit portfolio. Therefore, if you have $5,000 available to pay down debt, you should use those funds to completely pay off as many accounts as possible starting with the largest ones. That would eliminate those payments from your DTI calculation.

What you do not want to do is apply the $5,000 against an account that has a much larger balance without eliminating the monthly payment. The goal to lower your DTI is to lower the total monthly payments.

What is the maximum allowed FHA DTI ratio?

The maximum allowed FHA DTI Ratio with compensating factors is 56.9% which may be allowed by participating FHA lenders based upon some compensating factors which help to minimize the lender’s risk. However, it is up to the discretion of the lender whether they want to go that high.

What income can be used to calculate debt to income ratios?

The following types of income can be used to calculate debt to income ratios:

Monthly employment wages

- Income from your business

- Social security income

- 401k income

- Pensions

- Disability income

- Alimony and child support

- Investment income

- Income from a second job

Student Loans and FHA Debt to Income Ratio

FHA lenders are required to use .5% (half percent) of the student loan balance as part of the monthly obligations into the debt to income calculation. Read our article on student loans for more info.

FHA Debt to Income Ratio Calculator

To use the FHA DTI calculator, add your own information in the fields below and the calculator will determine your FHA debt to income ratios automatically. If the back end ratio is over 43%, we still have lenders who can help you with a mortgage. If your back end DTI below is up to 60%, then one of our FHA lenders may still be able to help you.

Insurance

Frequently Asked Questions about FHA Debt-to-Income Ratio

Can I qualify for an FHA loan with high DTI?

There are lenders that will allow for much higher DTI levels up to and over 50%. If you work closely with the right lender, they will help guide you through the process and can suggest ways to qualify.

Which lenders allow for a high DTI?

Although FHA guidelines permit a DTI up to 56.9%, lenders have the ability to adjust their standards and require a lower maximum DTI for the mortgages they originate. If you are having difficulty finding a lender who will allow for a higher DTI, then contact us and we will help you to locate one.

Can a Cosigner Help with FHA DTI?

Adding a cosigner can help with your DTI calculation to qualify for an FHA loan. However, the cosigner will need to being a higher ratio of income versus debt. If the cosigner has a high amount of monthly debt, then it may worsen your DTI calculation. Read more about adding a cosigner to an FHA loan.

What is the maximum allowable debt-to-income ratio for an FHA loan?

The maximum allowable debt to income ratio for an FHA loan is 56.9% for applications that are manually underwritten with compensating factors.

Does the FHA debt-to-income ratio include all types of debt?

The FHA debt to income ratio will include your proposed monthly mortgage payment plus any monthly payments that appear on your credit report.

Can a higher credit score compensate for a higher debt-to-income ratio?

Higher credit scores are one of the compensating factors that underwriters look for when reviewing loan applications.

What if my debt-to-income ratio exceeds the FHA requirements?

If your DTI ratio exceeds the FHA requirements, you must look for ways to either lower your proposed monthly payments or reduce your monthly debt.

How does the FHA debt-to-income ratio differ from other loan types?

FHA debt to income ratios are more forgiving vs conventional loans. If you are eligible for a VA loan, you may be allowed a higher DTI if the lender allows. USDA loans also allow for high debt to income ratios but there are income limits.

Can I use a co-borrower’s income to lower my debt-to-income ratio for an FHA loan?

Using a co-borrower with income and low monthly debt payments is a great way to lower the debt to income ratio on your loan application.

FHA Debt to Income Ratio Statistics

Related Articles

Getting an FHA Loan on Disability Income