FHA Inspection and Appraisal Guidelines 2024

If you are buying or selling a home where an FHA loan is involved, you will need to be prepared for having an FHA inspection on the home. This inspection is paid for by the buyer and is more in depth than a standard appraisal.

We will help educate you on the FHA inspection and appraisal process. Then, click to connect with an FHA lender who can provide you with a very competitive rate quote in all 50 states.

If you are selling a home and reading this to make sure your home can pass an FHA inspection, we can help with your next mortgage regardless of whether it is an FHA loan, conventional, or any other type of mortgage.

If you are inquiring about the FHA inspection because you are selling your home, we can help you with your next purchase even if you are looking for a conventional loan or some other creative mortgage program.

The Purpose of an FHA Inspection and Appraisal

An FHA inspection is a type of home inspection required for properties seeking financing through the Federal Housing Administration (FHA). FHA inspections are different from regular home inspections as they focus specifically on compliance with FHA guidelines and requirements.

The purpose of an FHA inspection is to assess the property’s condition and ensure it meets minimum safety and livability standards. The appraisal portion protects both the homebuyers and the lenders from engaging in a transaction for a home that is being sold above its true value.

The FHA checklist below will detail everything the inspector will be looking for. In general, they will be looking for any code compliance issues, electrical, plumbing and HVAC systems, foundations, water and air penetrations, and more. The inspector will follow the FHA’s home examination policies and procedures.

Read more about the FHA requirements on house condition.

Preparing for an FHA Inspection

If you are preparing for an FHA inspection, you will have different things to consider depending upon whether you are the buyer or the seller of the property. We will review both points of view below:

Preparing for an FHA Inspection as the Seller

If you are selling a home, there is a good chance the future buyer will ask for a home inspection especially if they are using FHA insured financing. Therefore, you should make sure there is nothing significant that can be picked up by the inspector that would allow for the homebuyer to back out of the sale, or for them to use as a negotiation point to reduce the price of the home.

We recommend taking a look at our inspection checklist below and honestly evaluate your home and whether you believe there are issues that need to be fixed before you enter into a sales contract. If you are not sure what to look for, have someone do a pre-inspection for you. Either a local contractor or someone who understands what to look for.

If you have done work without a permit, consider applying for and paying for a permit to prevent this from becoming an issue during the sale.

Preparing for an FHA Inspection as the Buyer

If you are the buyer of a home, you have less to worry about prior to the inspection as the sellers do. However, it would be helpful for you to do the following:

Make a list of anything you noticed during your last walk through of the property that concerned you. Provide this list to the inspector on the day of the home examination.

Go to the town building department and explain that you are in contract to purchase the home and you would like copies of any closed or open permits they have on record. Provide these to your inspector on the day of inspection. This will help to identify any work that may have been done without a permit.

If possible, schedule the inspection immediately after a day of rain. It will allow the inspector to identify any leaks that otherwise may go undetected.

Finally, you should absolutely be there on the day of inspection and walk with the inspector the entire time. You will learn a lot about your new home by listening to what they have to say. If your inspector does not want you there, then that is a red flag and you should consider selecting a different inspector.

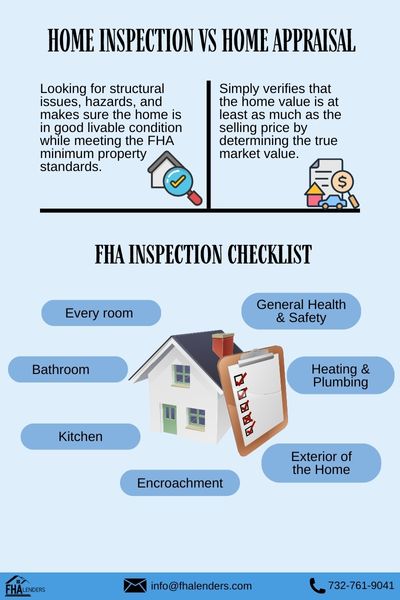

What is the Difference Between an FHA Inspection and an Appraisal?

An FHA inspection is an in-depth analysis of the home. It is looking for structural issues, hazards, and makes sure the home is in good livable condition while meeting the FHA minimum property standards. The FHA inspection also verifies the true market value of the home.

A standard non FHA appraisal simply verifies that the home value is at least as much as the selling price by determining the true market value. The appraiser will determine the home’s value based upon recent sales in close proximity to the home being purchased. Although the appraisal protects the buyer, its true intent is to protect the lender.

An FHA insured loan will require you to have the FHA inspection and appraisal. Read our article on FHA approved homes for more details on what is needed to meet the minimum property standards.

How much does an FHA Inspection Cost?

An FHA inspection will likely cost you anywhere from $300 – $600 depending upon the location and size of the  home. Although there is no set national price for an FHA inspection, you should budget on the high. The cost for the inspection may be included in the loan.

home. Although there is no set national price for an FHA inspection, you should budget on the high. The cost for the inspection may be included in the loan.

While most closing costs are paid at closing, inspections and appraisals are typically paid up front, you can get the seller to help pay for the cost at closing. Read our article on FHA closing costs for a full understanding on how that is handled.

When Do I Get an FHA Inspection?

The loan will first need to be conditionally approved. You pass the initial requirements for income, assets, credit, etc. Then, you are able to move ahead with the FHA inspection and appraisal. It is done in this order, so you do not spend money on an inspection if you do not meet the other qualification requirements.

Your inspector should provide you with the inspection and safety report within 48 hours after the date of inspection. You and find an inspector using the FHA inspector lookup tool.

How Long Does the FHA Inspection Take?

The FHA inspection will take a few hours since it is an in depth look at everything. There is an inspection checklist that will be followed, and it may take a few days before the full FHA inspection report is returned depending upon the inspector’s workload.

The length of time the inspection takes may be inconvenient for you and the seller, however it is extremely important for you that the inspector takes the time to perform a deep analysis into the home’s condition. You want the inspector to find any and all issues related to the condition of the home.

What will an FHA Inspector Look For?

First, the FHA inspection will determine the current market value. The inspector will compare the home to others that have recently sold nearby. The home will be compared to homes that have the same number of bedrooms, bathrooms and also similar property characteristics that may impact the home value (ie waterfront).

Next, the FHA inspector will perform a full inspection according to FHA guidelines making sure the home meets the minimum standards for an FHA approved home.

FHA Inspection Checklist

The FHA inspector will be looking at the following during the inspection process:

In Every Room – The following applies to every room in the home.

- Check whether the room has electricity and its condition

- Window condition

- Ceiling condition

- Wall condition

- Floor condition

- Security

- Presence of lead-based paint

- All doors are operational and are closing, latching and locking properly

Bathroom – The items below are unique to the bathroom portion of the inspection

- There must be a toilet and in good working condition with no leaks

- There must be a sink and in good working condition with no leaks

- There must be a tub or shower and in good working condition with no leaks

- There must be ventilation – can be an exhaust fan or window

Kitchen – The items below are unique to the kitchen portion of the inspection

- Stove or range with an oven in good working condition

- Refrigerator in good working condition

- Any other appliances included must be working

- Sink in good working condition and with no leaks

- Room for storage, food preparation and the serving of food

Exterior of the Home

- Condition of foundation

- Condition of stairs, railings and porches

- Condition of roof and gutters (maximum of 3 layers on the roof)

- Condition of siding

- Condition of the chimney

- Condition of exterior doors and weather stripping

- Condition of windows

- Lead paint on exterior surfaces

- Swimming pool (if applicable) must be in working order and adhere to local ordinances

Heating and Plumbing

- Heating unit is adequate and in good working condition

- Ventilation and cooling

- Water heater in good working condition

- Approved water supply (city sewer or well)

- Plumbing must exist and be in good working condition

- Sewer connection either to city sewer or an operable septic system

Basement or Crawl Space

- The inspector will look for evidence of water

- Inspection for evidence of termites

- Operational sump pump if applicable

- Exposed wiring and plumbing

- Insulation

General Health and Safety

- Working smoke detectors in the home

- Access to home for first responders

- Fire exists

- Pest infestation

- Garbage and debris

- Refuse disposal

- Stairs and common hallways must be adequate

- Elevators (if applicable) must be safe, inspected and working

- Interior air quality

- Site and neighborhood conditions (no nearby hazards)

- Lead-based paint owner’s certification

When the inspector is reviewing the list above, he or she will be making notes on their checklist indicating the presence of these conditions as well as any repairs that may be needed.

Encroachment

No portion of the dwelling or improvement may encroach onto a neighboring property. In similar fashion, a neighbor’s structure may not encroach onto the property you are purchasing. These issues must be resolved before closing.

If the encroachment is due to a fence, that fence may remain as long as it does not negatively impact the value of the home.

FHA Home Inspection for Safety and Health

Safety is very important during the FHA inspection. The inspector will look for hazards inside and outside of the home. This could be a leaking oil tank on the property or a toxic waste dump next door. Yes, that is an extreme example, but conditions nearby will determine whether the home passes the inspection.

If the home is in close proximity to an airport and its flight pattern, that may result in extreme noise hazards that could disqualify the home from being financed with an FHA loan.

The inspector will also make sure every bedroom has a window or a door to be used as a fire escape. The home must also have adequate access for police, fire and ambulance emergencies. This means the home could be on a dirt road, but it must be in passable condition.

FHA Required Repairs

FHA’s inspection guidelines require any issues the inspector finds that he deems to be a required repair be done and verified before closing. However, if the home buyer is applying for an FHA 203k rehab loan, those repairs can be done by the buyer after closing.

What Happens if the Home Fails the FHA Inspection?

The home will not “fail” inspection but there may be things noted on the inspection that did not pass. The repairs or modifications noted by the inspector would need to be made before the loan can close. This means the current homeowner would need to make those repairs or pass on selling to an FHA buyer.

If there are repairs that cannot be made prior to closing, the lender can setup an escrow account for the repairs to be made afterwards. The escrow account will include the cost to make the repairs and borrower labor is not considered as part of the costs.

The home must be in habitable condition excluding these repairs. Meaning, if the home needs windows fixed or some floors repaired then that is fine. However, if there is no working kitchen or bathroom (as an example), then the loan will not close.

With non-FHA loans, the buyer and seller can negotiate a reduction in price to cover the repairs for the buyer to manage on his or her own after closing. That cannot happen with an FHA loan. All repairs need to be made prior to closing.

FHA Inspection Tips for the Sellers

If you are selling your home, there is a good chance the buyer may be considering an FHA loan. Especially due to the many benefits of an FHA loan and the fact that 25% of all mortgages today are FHA insured.

As a home seller, it is a good idea to review the FHA inspection checklist referenced above and make the appropriate repairs before you put your home on the market. An FHA loan can be problematic for home sellers if they are not prepared.

There are some large ticket items that you may not be able to ignore. For example, if the roof is old and leaking or you have termites. These things will need to be repaired regardless as to whether you sell your home. In addition, fixing these conditions and anything else that is visible to potential home buyers will likely help you to get close to your listing price.

How an FHA Failed Inspection Can Help Buyers and Sellers

Many sellers are concerned about the inspection when a buyer plans to use an FHA loan because they do not want to repair everything the inspector found to be a problem. Buyers are also worried they may lose the home of the seller does not want to make the repairs.

The perfect solution to this is the FHA 203k rehab loan. With this unique FHA program, the cost of the repairs can be included in the loan amount. It not only provides funding for “problems” the inspector found but it can also be used to make changes that you would like to make to update the home to your liking. This program helps both the buyers and sellers.

FHA Inspection Case Study

We recently helped a home buyer couple to secure an FHA loan for the purchase of their first home. They were not familiar at all with the process, inspections, or what to look for when shopping for a home.

They eventually found a home they liked, and their offer was accepted. The lender submitted the file to underwriting and the loan was conditionally approved.

Their real estate agent helped them to find an FHA inspector and the inspection was scheduled to occur on a Saturday. They were urged to attend the inspection so they can see first hand what the inspector was finding. It was a great way to learn during this process.

Two days after the inspection, they received the report from the inspector. What they found was the home was generally in good condition. However, a small leak was detected in the attic and the insulation was damp. The inspector also discovered both the furnace and hot water heater were working, but they were over 20 years old and at the end of the life expectancy.

The homeowner was asked to fix the leak in the roof. Meanwhile, the furnace and hot water heater passed inspection because they were working. However, the buyers needed to take the age of those items into consideration with the expectation that they may need to be replaced soon.

The inspection provided some transparency and visibility to the home’s condition to the buyers.

Frequently Asked Questions about FHA Home Inspections

How long does an FHA inspection usually take?

On average, the FHA inspection can take up to 3.5 hours. This is time well spent to do a thorough examination of the home and for you to get a better understanding of the home’s true condition.

Can I prepare my home for an FHA inspection?

As the seller, you should absolutely prepare your home for an FHA inspection, or any type of inspection. Since the FHA inspection is the most thorough, we recommend using our inspection checklist to determine what may need to be repaired.

How much does an FHA inspection cost?

An FHA inspection can cost $300-$600 and the price is based upon the size of the home and your geographic location.

Can the seller pay for the cost of the FHA inspection?

The seller can cover the cost of the inspection by providing you with a closing cost credit.

What is the home fails inspection?

If the home fails inspection, the seller has the choice of making the repairs or exiting the sales contract. The buyer has the option of switching the loan to an FHA 203k rehab loan to make the repairs on their own after closing, or walking away from the home purchase.

What happens if the seller does not want to make the inspection repairs?

If the seller does not want to make the repairs, you have the right to cancel the purchase contract.

Summary

The FHA inspection and appraisal are mandatory and an important part of the process when applying for an FHA loan. Buyers should look at it as an added measure of protection when buying a home. Sellers should plan ahead in preparation for an FHA inspection by making obvious and significant repairs before listing the home for sale.

FHA Inspection Statistics

Click to connect with an FHA Lender who can help

Related Articles

FHA Rules for Homes in a Flood Zone