FHA Loan for Self Employed

FHA Self Employed Guidelines

An FHA loan for self-employed individuals is obtainable if you are able to meet the minimum qualifying guidelines for self-employed income documentation and length of self-employment.

FHA loans offer many benefits including the low-down payment and credit score requirements. However, self-employed individuals often cannot qualify using the net income on their tax returns. Below, we will show you how you can qualify for an FHA loan if you are self-employed.

Click for a Free Rate Quote with No Credit Pull

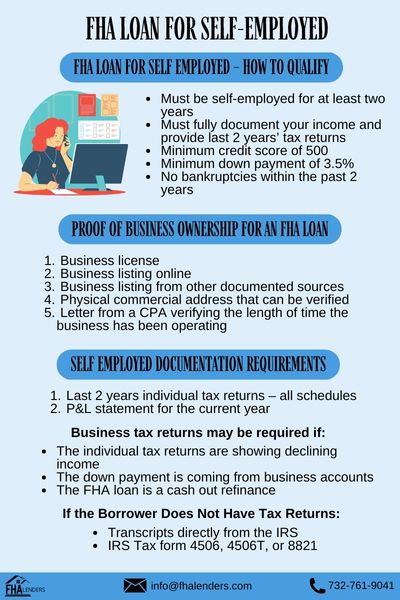

FHA Loan for Self Employed – How to Qualify

There are some basic requirements for anyone to qualify for an FHA loan. In addition, there are a few more requirements that a self-employed individual must meet:

- Must be self-employed for at least two years

- Must fully document your income and provide last 2 years’ tax returns

- Minimum credit score of 500

- Minimum down payment of 3.5%

- No bankruptcies within the past 2 years

Proof of Business Ownership for an FHA Loan

The lender is required to verify that your business has been established for at least two years. You may be required to show one or more of the following:

- Business license

- Business listing online

- Business listing from other documented sources

- Physical commercial address that can be verified

- Letter from a CPA verifying the length of time the business has been operating

The FHA guidelines also require the borrower to have at least 25% ownership in the business.

FHA for Self-Employed Documentation Requirement

Some or all of the following may be needed depending upon the lender and/or underwriter. These document requirements are unique to self-employed borrowers and are in addition to bank statements and some of the other documents that are required from anyone who is applying for an FHA loan.

- Last 2 years individual tax returns – all schedules

- P&L statement for the current year

Business tax returns may be required if:

- The individual tax returns are showing declining income

- The down payment is coming from business accounts

- The FHA loan is a cash out refinance

If the Borrower Does Not Have Tax Returns

If the borrower cannot provide the most recent year’s tax returns, the lender may use one of the following documents in lieu of those returns:

- Transcripts directly from the IRS

- IRS Tax form 4506, 4506T, or 8821

Self Employed Income for an FHA Loan

Self-employed income must be steady or increasing over the past two years. If the income has declined by 20% in the most recent year, the mortgage application may require manual underwriting where compensating factors may be needed to approve the loan.

If you find yourself in a situation with declining income and would like to qualify for an FHA loan, there may be some creative ways to secure an approval.

How Self-Employed Income is Calculated for an FHA Loan

FHA lenders are required to use the average of the past two years’ income on your tax returns to determine the income to be used on your mortgage application (effective income).

As an example, if our 2018 tax returns show a net income of $85,000 and your 2019 tax returns show a net income of $95,000, then the lender will use $90,000 per year as your annual income for qualification purposes.

Business Debt on Personal Credit Report

FHA Guidelines indicate if a borrower has business related monthly debt or obligations appearing on their personal credit report, the lender must obtain documentation that the debt is being paid for from business accounts and that debt was calculated in the business P&L statement.

Using Business Funds to Close an FHA Loan

You may use money from your business accounts towards your down payment or closing costs. However, you may then be required to provide your business tax returns to the lender and factor those financials into the application.

FHA Loan for Self-Employed – Frequently Asked Questions

What if I have not been self-employed for two years?

If self-employed for less than two years but greater than one year, the lender may consider the borrower’s income if they were previously employed in the same line of work for at least two years.

Can an LLC get an FHA Loan?

If you own a business that is an LLC, you can get an FHA loan. However, the FHA loan cannot be in the name of the LLC.

Can a Business get an FHA Loan?

A business cannot get an FHA loan because FHA loans are solely meant for individuals who wish to finance a primary residence. When a business is purchasing or borrowing against a property, it is typically for investment purposes and therefore would not be eligible for an FHA loan.

Are their FHA Bank Statement Loans?

Bank statement loans are for self-employed borrowers who would qualify using bank deposits rather than the net income on their tax returns. Unfortunately, FHA guidelines do not have a bank statement loan feature.

Related FHA Articles