FHA Loan Requirements

FHA loans are used for more than 25% of all home purchases in the United States. Understanding the FHA loan requirements well before you begin shopping for a home will help make the whole process much easier.

There are specific FHA guidelines that are published in the FHA handbook and since there are hundreds of pages to read through, we outlined the key points that you need to know.

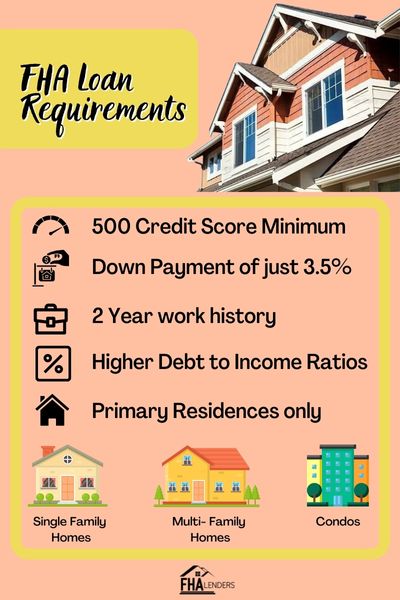

The basic FHA loan requirements include credit scores of at least 580, a 3.5% down payment, and a two year work history.

Why Get an FHA Loan and Who are They For?

If you have good credit and at least 20% to put down, then it is possible that an FHA loan is not the perfect fit for you. However, if your credit scores are lower, or you have little to put down and possibly have a lot of debt, then you should seriously consider an FHA loan.

In general, FHA loans are perfect for people who fit following criteria:

- Home buyers who require a small down payment

- Borrowers who have a lower credit score

- Borrowers who have a high debt to income ratio and cannot qualify for a conventional loan

- Home buyers who want to borrow money to purchase the home and to make repairs

FHA Loan Requirements for 2024

These are the minimum FHA loan requirements when trying to qualify for an FHA loan.

- Minimum FICO score requirement of 500

- Minimum down payment requirement of 3.5% (10% for scores under 580)

- Mortgage Insurance Premium (MIP) is required for every FHA loan

- Maximum debt to income ratio of 56.9%

- The home must be your primary residence

- The borrower must have a 2-year work history with steady income

- You must be able to fully document your income

- Home must pass FHA inspection

If you believe you may not meet all of these FHA loan requirements, then we suggest speaking with a loan officer. There are ways to overcome challenges which may have prevented you from qualifying in the past.

*FHA Loan Requirements Chart

| FHA Loan Requirement | |

| Minimum FICO Score | 500 |

| Down Payment | 3.5% (10% with credit under 580) |

| Debt to Income Ratio | Up to 56.9% |

| Work History | 2 years full time employment |

| Mortgage Insurance | Required |

| Income | Must be fully documented |

FHA Loan Benefits

These are the benefits of an FHA loan versus a conventional loan:

- Lower credit scores permitted

- Lower down payment requirement

- FHA terms are more competitive than conventional

- Gift funds allowed

- Seller closing cost contributions are allowed

- FHA loans are assumable

- Co-signers allowed

- Higher debt to income ratios permitted

FHA loan disadvantages versus a conventional loan:

- Upfront mortgage insurance of 1.75%

- Mortgage insurance (MIP) on a monthly basis is higher than PMI

- Mortgage Insurance is in place for the life of the loan

- More paperwork is needed for an FHA loan

- FHA loans cannot be used to purchase expensive homes

FHA Credit Requirements

At one point, you needed a FICO score of 640 to qualify for an FHA loan. Now, you can get an FHA loan with a FICO score as low as 500. As detailed in the image below, the down payment requirement would increase once your credit score drops below 580.

Although there are minimum credit requirements for FHA loans, lenders have the option to implement stiffer requirements as an added measure of risk mitigation for them. This is why not all FHA lenders will actually help if your credit score is below 580. Here at FHA Lenders, we have aligned ourselves with lenders who do accept the lower credit scores.

There are also FHA loan requirements related to collections and other items on your credit report which need to be understood. For example, medical disputes can be excluded from the credit analysis during the underwriting process of your FHA mortgage application. Read more about the FHA Credit Requirements if you have any additional questions.

FHA Down Payment Requirements

The FHA down payment requirements are 3.5% of the purchase price if your credit score is 580 or higher. If your score is below 580, then you will be required to put 10% down. If you do not have the down payment, then read about FHA gift funds and learn how you can get a gift from a relative to use for your down payment.

If you do not have the down payment now, but will sometime in the near future, then connect with one of our FHA lenders here and begin the discussion. They will help guide you through the process and prepare you for a successful real estate transaction.

FHA Debt to Income Ratio Requirements

The FHA debt to income (DTI) requirements in general are 31% for only housing related expenses, and 43% for the total debt including the proposed housing expenses and all other monthly debt that appears on the credit report.

The FHA guidelines permit lenders the flexibility to allow for a total DTI of up to 50% if there are additional compensating factors such as no payment shock, a high level of cash reserves, or additional income that may not be documented on the loan application.

The debt to income ratio calculations are as follows:

Front End Ratio – Housing Only

Monthly gross income = $5,000

Proposed housing payments = $1,500

$1,500 ÷ $5,000 = 30%

Back End Ratio – Total Debt to Income Ratio

Monthly gross income = $5,000

Proposed housing payments = $1,500

Monthly car payment = $250

Monthly credit card minimums = $75

Total monthly debt = $1825

$1825 ÷ $5,000 = 37%

In the scenario above, the debt to income ratios are 30% / 37% which is well within the FHA guidelines for debt ratios. Read more about FHA DTI Requirements.

FHA Closing Cost Requirements

FHA loans also have closing costs and depending upon the loan amount your closing costs may be anywhere from 2.5% – 5% of the total loan amount. Read more about FHA closing costs so you can be prepared for what to expect. The closing costs can be covered by the seller of the home and negotiated during the home purchase.

These are some of the basic FHA closing costs that you can expect to see.

- Credit Report – ($25)

- Loan Origination Fee – (.5% – 1%)

- Discount Points – (1%)

- Underwriting Fee – ($350 – $975)

- Document Preparation Fee – ($50-$100)

- Home Inspection – ($300-$400)

- Appraisal – ($450)

- Survey – ($400-$500

- Attorney Fee – ($750)

- Title Search – ($100)

- Title Insurance – ($900 – $1200)

- Tax Service Fee – ($50)

- Recording Fees – ($70)

- Wire Transfer Fee – ($25)

- Pre-Paid Property Tax (TBD based upon the home’s taxes and timing of your closing)

- Tax Escrows – (Varies based upon property taxes of the home).

- Notary Fees – ($10)

- Homeowner’s Insurance – ($400-$1200)

- Flood Certification Fee – ($15)

- FHA Upfront Mortgage Insurance MIP – (1.75% of the loan)

Some of the closing costs may be financed or can be covered by the seller as mentioned above. If you received FHA gift funds, you could use any excess funds from your down payment to cover closing costs too. Read more about FHA closing costs in greater detail. We will outline everything for you and help you to understand what you can expect to pay for each of the items listed above.

Mortgage Insurance Premium (MIP)

FHA loan requirements also include a mortgage insurance premium. There is the upfront mortgage premium of 1.75% of the loan amount which gets paid at closing. Then you have the annual mortgage insurance premium which gets split equally across your monthly mortgage payments.

The mortgage insurance premium is an insurance policy that protects the lender in the event that you default on the loan. This is something that needs to be considered when applying for an FHA home loan.

In our dedicated article about mortgage insurance premiums, we will provide you with the calculations, all of the rules regarding the FHA MIP and also whether you can get it removed from your mortgage. The image below details how the annual or monthly mortgage insurance premium rates are determined. The percentages to the right are applied against your initial loan amount.

FHA Documentation Requirements

When you apply for an FHA loan, you must provide the following documentation:

- Social security number or card

- Driver’s license or some other form of ID

- Pay stubs and W2s (for wage earners)

- Tax returns (for wage earners and self-employed borrowers)

- Bank Statements

- Account statements for any other liquid financial accounts

- 1003 loan application

- Form HUD-92900-A – this is an addendum to the 1003 loan application

- Written verification of employment

- Credit report

- Appraisal Report

- Sales contract for purchases

- Copy of the deed for refinances

At the time of application, there may be additional documents required.

FHA Property Requirements

FHA loans can be used to purchase primary residences only and they must be single family homes up to a maximum of a 4-unit building.

You may purchase a condo that is an FHA approved condo. Use the FHA approved condo lookup tool to determine whether the condo you are interested in buying qualifies for an FHA loan.

Additional FHA property requirements:

- You must occupy the property as your primary residence within 60 days of closing.

- The property cannot be a fix and flip

- The property must meet minimum property living standards and deemed to be “safe”, “sound” and “secure”.

- The property cannot be an investment

- There may not be an encroachment onto a neighboring property or vice versa.

- No overhead powerlines are permitted

- There must be sufficient access to the property for emergency vehicles

- Free from hazards or toxins.

Read more about FHA approved homes.

FHA Loan Limits

The FHA loan requirements also outline very specific loan limits for each county. For 2019, the loan limit for a single family residence was raised to 420,680 and up to $970,800 for designated high cost counties. Those loan limits are even higher for 2 unit, 3 unit, and 4 unit properties.

Check out the FHA Loan Limits lookup page to determine what the loan limits are in your county.

FHA Appraisal Requirements

Every home purchased with an FHA insured loan must have an appraisal performed by an approved appraiser. The appraisal is needed to make sure the home is worth what the home buyer is paying for the home. Not only does it protect the buyer, but it also protects the lender from losses.

In addition to evaluating the value of the property, an FHA appraisal will also look for the following:

- Lead paint

- Systems such as heating and cooling are operating

- Operational fixtures and appliances

- Plumbing and electrical problems

- Foundation problems

- Hazards

- Poor drainage

- Roof in good condition

- The overall condition of the home

FHA Loan Requirements for Sellers

From a lending perspective, there are no specific FHA loan requirements for the sellers of a home that will be financed with an FHA insured mortgage. However, sellers can do a lot to help make their home better suited to be sold to someone who plans to use FHA financing.

You can see from the appraisal checklist that the home must pass a thorough inspection. As a seller, it is important to make sure that your home meets all of the requirements set for an FHA approved home.

You must also be mindful of how you price your home. If there is a high concentration of FHA financed homes in your area, then you could use that to your advantage when pricing your home. Think about the future negotiation that may occur as it relates to covering borrower closing costs.

FHA Loan Requirements – Summary

There are quite a few FHA loan requirements when it comes to qualifying, documentation and various other requirements. However, FHA loans are the best option for at least 25% of the United States population. An FHA loan is a great way to finance your home so let us help you to get connected to an FHA lender who is an expert in your area.

Related FHA Articles

Pros and Cons of FHA Home Loans – Kyle Hiscock

Should You Get an FHA Loan? – Kevin Vitali

FHA Underwriting Guidelines – Luke Skar

FHA Loans with a Part Time Job

Rules for FHA Homes in a Flood Zone