FHA Loan With a Cosigner

Many home buyers will use FHA financing to purchase a home this year because this loan program allows for a low-down payment and flexible credit requirements. Qualifying may still be difficult for some people and applying for an FHA loan with a cosigner could bring the DTI down to within FHA guidelines which can help with the mortgage approval.

Can you use a cosigner with an FHA loan?

FHA guidelines will allow a non-occupant cosigner that meets the HUD borrower eligibility requirements to be on the mortgage. In some instances, adding a cosigner may help the home buyer to qualify for an FHA insured home loan.

Click to get Pre-approved for an FHA loan with a co-signer

When to Use a Cosigner?

You should apply for an FHA loan with a cosigner if you have a high DTI and need additional income to qualify for the mortgage. The DTI (debt to income) level is used to determine a borrower’s ability to comfortably make the monthly mortgage payments. Read our article about FHA debt to income ratios to learn more about the topic.

Another instance where you may need to use a cosigner is if your current income level is high enough, but cannot be used because you do not have a full two-year work history. Adding a cosigner may help to get the mortgage approval if the cosigner can qualify on his or her own without factoring your income.

When a Cosigner Should Not be Used

A cosigner should not be used if you have poor credit scores and your goal is to add a cosigner with much better credit to help with your qualification or to get a better interest rate.

When FHA lenders review a mortgage application with two borrowers, they will always use the credit scores from the borrower with the worst credit. So, even if you add a cosigner to the application, if that person’s credit is better than yours, the lender will still use your credit score.

If the co-signer’s credit scores are worse than yours, then it will hurt your loan application from a credit perspective. You may still have to use the cosigner if his or her income is needed to qualify.

A co-signer also should not be used if the individual does not have steady income, does not have a two year work history, or has a bankruptcy that is less than two years from the discharge date. Every co-signer will need to meet the minimum standards and guidelines set for anyone who applies for an FHA loan.

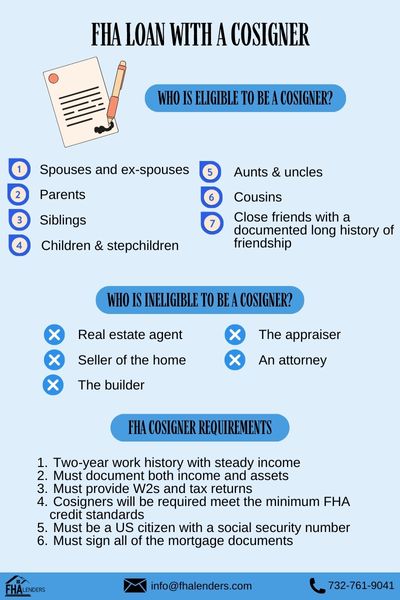

Who is Eligible to be a Cosigner?

If you are applying for an FHA loan with a cosigner, the HUD’s borrower guidelines will permit relatives to participate as a cosigner. These relatives include the following:

- Spouses and ex-spouses

- Parents

- Siblings

- Children and stepchildren

- Aunts & uncles

- Cousins

- Close friends with a documented long history of friendship

There is a requirement that the cosigner must be a US citizen so even if the individual is a relative, if he or she is not a citizen then they are not eligible to cosign for an FHA loan.

Who is Ineligible to be a Cosigner?

The cosigner cannot be someone who is close to, or has a financial interest in the real estate transaction. The following are examples of individuals involved in your purchase who cannot be a co-signer.

- Real estate agent

- Seller of the home

- The builder

- The appraiser

- An attorney

These are just a few common examples of who is ineligible to be a cosigner. Since it excludes anyone with a financial interest in the transaction, others could be added to the list who may fit that criteria.

FHA Cosigner Requirements

Cosigners will be held to many of the same requirements as the primary borrower of an FHA loan. It is as if they are applying for the mortgage themselves. Cosigners should be prepared to meet the following requirements:

- Two-year work history with steady income

- Must document both income and assets

- Must provide W2s and tax returns

- Cosigners will be required meet the minimum FHA credit standards

- Must be a US citizen with a social security number

- Must sign all of the mortgage documents

If you have any questions about any of these requirements, just contact us and we will walk you through the process. Read [FHA Credit Standards]

FHA Non Occupying Co-Borrower

The difference between a non occupying co-borrower and a cosigner is the non occupying co-borrower has ownership in the property while the cosigner does not. In both instances, the co-signer and the non occupying co-borrower sign for the mortgage and are responsible for the repayment of the mortgage.

Pros and Cons of Using a Cosigner

There are some very clear pros and cons of using a cosigner when applying for a mortgage. This is from the perspective of the borrower or the individual who is purchasing the home.

Pros

- Will help you to qualify for the mortgage

- You may get help from the cosigner if you are struggling to make payments

Cons

- A cosigner cannot help with poor credit issues

- Could potentially strain the relationship with the cosigner in the future

Risks for the cosigner

In a situation where a cosigner is added to the mortgage application, virtually all of the risk rests with the cosigner with little to no reward. Anyone volunteering to cosign for an FHA loan should understand these risks:

- Mortgage payment on Credit Report – Although the cosigner may not be making any of the mortgage payments, that monthly payment will appear on the cosigner’s credit report.

- Late Payments – Any late payments made by the borrower will also appear on the cosigner’s credit report and will likely have a negative impact on his or her credit scores.

- Foreclosure – If the borrower defaults on the mortgage and the property goes into foreclosure, that foreclosure will also be on the cosigner’s record.

- Ability to apply for another mortgage – Having the cosigned mortgage on the cosigner’s credit report will make it difficult for the cosigner to also apply for a mortgage and possibly qualify for additional types of credit in the future

In the end, there is little to no benefit at all for the cosigner which is why the FHA guidelines require the cosigner to be a relative. The thought is the cosigner may be more likely to contribute towards the mortgage payments if needed to support his or her relative.

First Time Home Buyer with Parent Co-Signer

Many first time home buyers are younger and look to have their parents co-sign to help them qualify for the mortgage. Although parents are eligible to co-sign an FHA loan, it is important to have a refinance strategy at some point in the future to eventually remove them from your mortgage.

Another important factor to consider is your parent’s credit scores will be impacted by your ability to pay the mortgage on time. Therefore, if you ask your parent’s to cosign your mortgage, you have a greater responsibility to preserve the health of their credit.

Related Questions

Can a friend be a cosigner?

A friend can be a cosigner but the FHA guidelines require the friend to be one that has a documented long history with the borrower. An example would be a girlfriend or boyfriend who you have been dating for many years. The person is not a blood relative or a spouse but has a close connection to you.

Can I use a cosigner with bad credit?

You can use a cosigner with bad credit, but their credit scores will be used during the underwriting process if his or her scores are lower than yours. If you believe the credit scores may be a problem, then read our article on applying for an FHA loan with bad credit.

Should I use a cosigner to help with the down payment?

You should never use a cosigner to help with your down payment. Instead, you should simply ask the individual to provide you with a down payment gift. This would not require the person to also be responsible for the repayment of your mortgage. If you would like to learn more, then read our article on FHA gift funds to see how this could work.

Can the cosigner help make the mortgage payments?

A cosigner can help to make the mortgage payments and would be required to make those payments if the primary borrower cannot. This is something that should be discussed before signing the mortgage documents.

Can I remove a cosigner from an FHA loan?

There really is no way to remove cosigner from an FHA loan without refinancing the mortgage. Most FHA lenders will require you to do a streamline refinance which can be done fairly quickly and will little to no out of pocket costs.

Related Articles

FHA Loan with a Part Time Job – See how you can qualify with a part time job if that job is your only source of income or a second job to supplement your income.

FHA Loan While on Disability – If you are on disability and receiving disability income, you may be able to use that income to qualify for an FHA loan

FHA Down Payment Assistance – If you cannot raise the money needed for your down payment, then you may have access to down payment assistance programs in your state.

FHA Loan Requirements – This article will take you through all of the basic FHA loan requirements in detail.