FHA Loan with Rental Income and Rental Guidelines

Rental income can be used to qualify for an FHA loan and FHA loans can also be used to purchase rental properties if the subject property will also be used as a primary residence. There are also a few very specific guidelines that must be followed and verified by the mortgagee before the loan can be approved.

Over the past two decades, we have helped thousands of home buyers to finance multi unit homes with an FHA loan.

Click to get Pre-Qualified Using Rental Income

FHA Loan with Rental Income Eligibility Guidelines

Once you complete your mortgage application, the lender will initially look for the basic requirements of income, debt, credit scores, tax returns, and W2’s. The down payment of 3.5% is still required and each FHA loan must also have mortgage insurance. You can review the basic FHA loan requirements here.

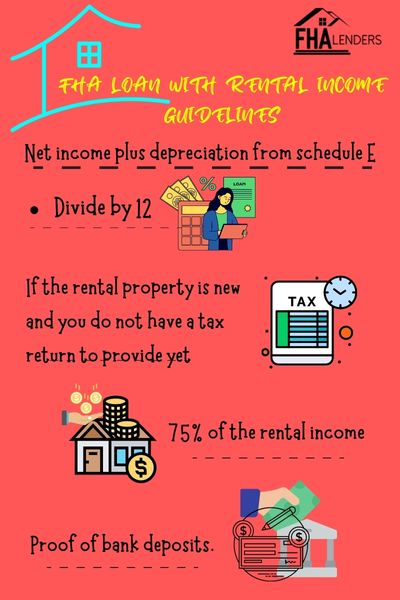

For properties that have rental income potential, there are additional financing and application requirements the lender must follow. FHA guidelines will require the lender to use the net income plus depreciation from schedule E of your tax returns and then divide by 12. The fact that they allow you to add depreciation back into the calculation helps you to qualify because it boosts your gross monthly income.

If the rental property is new to you and you do not have a tax return with this property included to provide yet, the lender will then use 75% of the rental income on your loan application. Keep in mind that you may be required to provide copies of the lease or leases for multiple units along with proof of bank deposits.

HUD 4000.1 also says: “The lender may consider Rental Income from existing and prospective tenants if documented in accordance with the following requirements. Rental Income from the subject Property may be considered Effective Income when the Property is a two- to four-unit dwelling, or an acceptable one- to four-unit Investment Property.”

Two- to Four-Units

The FHA lender will need to verify the propose rental income by securing an appraisal detailing the fair market rental value. If there are any existing leases for the property, those can be used in lieu of the appraisal.

One Unit

The FHA lender will need to “verify and document the proposed Rental Income by obtaining a Fannie Mae Form 1004/Freddie Mac Form 70, Uniform Residential Appraisal Report; Fannie Mae Form 1007/Freddie Mac Form 1000, Single Family Comparable Rent Schedule; and Fannie Mae Form 216/Freddie Mac Form 998, Operating Income Statement, showing fair market rent and, if available, the prospective lease.” – per Hud 4000.1

When the Borrower Does Not Have a History of Rental Income

If there is no history of rental income on the subject property documented on the previous tax returns, the FHA lender must use the lesser of the following”

–the monthly operating income disclosed on Freddie Mac Form 998; or

–75 percent of the lesser of the following:

A. fair market rent reported by the Appraiser; or

B. the rent as outlined in the lease agreement

This underwriting requirement is also called the FHA 75 rule which is explained in greater detail below.

FHA Rental Income for the Home You Plan to Purchase

If the subject property is going to have rental income, you can use that future income to qualify for an FHA loan. FHA guidelines require the lender to complete HUD form 92561 to determine “Self Sufficiency Rental Income Eligibility.” It is defined as the Rental Income produced by the subject Property over and above the Principal, Interest, Taxes, and Insurance (PITI).

According to Hud 4000.1, “Net Self-Sufficiency Rental Income is calculated by using the Appraiser’s estimate of fair market rent from all units, including the unit the Borrower chooses for occupancy, and subtracting the greater of the Appraiser’s estimate for vacancies and maintenance, or 25 percent of the fair market rent.”

Read more about the FHA self sufficiency test which is required when purchasing a home or property with a total of 3 or 4 units.

FHA loan renting restrictions

The only true FHA loan renting restriction is you are unable to get an FHA loan for a property where renting the home is its sole purpose. The property must also be used as your primary residence. If the primary residence status is met, then there are no restrictions on receiving rental income.

Penalty for renting an FHA home

The FHA does not have a specific penalty for renting a home with an FHA loan. However, they do require the home buyer to live in a home that was financed with an FHA insured loan for one year before moving out and renting it to others.

If it is discovered that you intended on renting the home without making it your primary residence, then you could be charged with mortgage fraud. The mortgage fraud penalty could result in up to one year in jail plus fines in the thousands of dollars.

FHA Departing Residence Rental Income

FHA guidelines will permit you to use the rental income for the home you currently live in if you plan to rent it out when buying a new home. However, your new home must be at least 100 miles away. This is outlined in the FHA 100 mile rule.

Click to have a confidential conversation to answer your questions

Buying a Home to Live in and Rent Out

If you are interested in owning real estate and being a landlord, purchasing a multi family home with an FHA loan is a great way to get started. This is especially true if you are a novice at property management or have never owned a home before.

Our first suggestion if you find a home you are interested in is to get the the cash flow information from the seller. This would include a rental agreement for each of the rental units and also copies of the utility bills and other expenses. This is your way to verify what the potential cash flow will be. You do not want to find yourself in a negative cash flow situation and you should also know when the current leases will expire.

It would also be a good idea to speak with an accountant about what you can expect from a rental income tax perspective. Plus, a list of expenses you should track to use as a tax deduction at the end of the year.

Day to day, you should be prepared to deal with tenant complaints and have the ability to make repairs where needed.

Frequently Asked Questions Related to FHA Rental Income

These questions are most commonly asked by people who are considering purchasing a multi family home with an FHA loan:

How Long Do You Have to Live in an FHA Home Before Renting

FHA guidelines require you to live in the home for at least one year before transitioning it to a rental property. However, if you purchase a multi family home, you can rent the non owner occupying portion of the property immediately after making the purchase.

Can rental income from borders be used to qualify for an FHA loan?

Rental income from borders can be used if the borrower has a two year history of receiving rental income from borders (documented on tax returns) and if he or she is currently receiving rental income from borders.

Can I rent out a room in my FHA house?

There are no FHA restrictions for renting out a home with an FHA loan. However, it is unlikely you can use the potential future rental income to qualify for the FHA loan.

What if the rental income is paid in cash?

You will be required to document the rental income received. If the tenant is paying in cash, it is important to deposit that cash in your bank account to record the transaction. If possible, also get a signed transaction receipt from the tenant as it will also protect the tenant from delinquency claims.

Does FHA Check Owner Occupancy?

Although FHA guidelines have strict rules mandating that homes purchased with FHA insured financing, they do not send inspectors to verify owner occupancy. If you intentionally purchase a home using FHA financing without planning to live in the home, that is considered to be occupancy fraud. Individuals who are convicted of occupancy fraud may face fines, penalties and possibly jail time.

What is the FHA 75 Rule?

The FHA 75 rule is when a home buyer is capped at using 75% of the rental income of a multi family property to help qualify for the FHA loan. The lender will use the current leases in place or the estimated rental income noted on the appraisal.

Can I include rental income when applying for an FHA loan?

If you already own rental properties, you can and should include the rental income when applying for an FHA loan. That income is needed to offset any mortgages that may appear on your credit report.

How is rental income calculated for an FHA loan application?

Rental income is calculated based upon the current rent of you own the home already or 75% of the market rent if the property is new to you.

Are there any limitations on the amount of rental income that can be considered?

There are no limitations on the amount of rental income that you can use if that rental income can be documented.

Do I need a certain length of rental history to use it for an FHA loan?

There is no minimum rental history requirement for an FHA loan. However, if you plan to use 100% of the rental income, then you need to have history of those rents for at least one year.

Is there a specific occupancy requirement when using rental income for an FHA loan?

The occupancy requirement for any FHA loan is you must reside in the home for at least one year as your primary residence. That is the requirement regardless of whether you are using rental income.

Can I include rental income from multiple properties on an FHA loan application?

If you own multiple properties then you are required to include the rental income in addition to any debt or mortgage associated with those properties.

How much rental income is needed for an FHA loan?

For 1-2 unit properties you simply need enough total income (rental plus your other sources of income) to qualify for an FHA loan based upon the maximum debt to income ratio requirements. However, for 3 or 4 unit properties, the rental income must be high enough to cover the proposed mortgage payment.

How can I increase my chances of getting approved for an FHA loan with rental income?

First, make sure you have good credit because of the rest of the application is borderline, having good credit can be a compensating factor. Next, search for properties where the rents are high in proportion to the cost of the home.

What is the FHA interest rate for homes with rental income?

The interest rate will be the same for you regardless of whether you are using rental income to qualify. Rates are determined by other factors such as your credit scores and down payment.

Facts About Applying for an FHA Loan Using Rental Income to Qualify

Related Statistics of Buying a Home with Rental Income and FHA Loans

Other Helpful FHA Articles – FHA Loan with Rental Income

Can You Get an FHA Loan Twice?

FHA Loan Without a Two Year Employment History