FHA Multi Family Loan Guidelines

For some people, home ownership is purchasing a traditional single-family residence on a quiet street with a big backyard and a two car garage. However, for the investment minded individuals, a multi-family home is their choice when it comes to purchasing their first home.

The FHA multi-family loan guidelines permit home buyers to purchase a 2-4 unit property with the benefits of a low down payment FHA loan. This is a great way to begin building wealth quickly while also having your tenants cover some or all of your own housing expenses.

Click to Find a Lender in Your Area

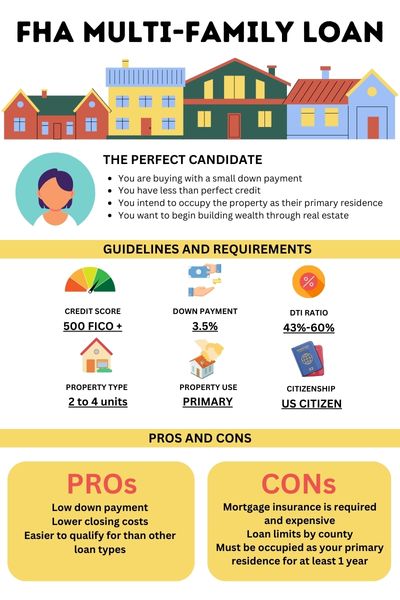

Who is the Perfect Candidate for an FHA Multi Family Loan?

FHA offers this great program to the same individuals who would also qualify when purchasing a single family residence. In general, you may want to consider this program under one ore more of the following circumstances:

- You are buying with a small down payment

- You have less than perfect credit

- You intend to occupy the property as a primary residence

- You want to begin building wealth through real estate

If any of these apply to you, then keep reading and you may change the way you think about home ownership and whether an FHA multi family loan is for you.

FHA Multi-Family Loan Guidelines and Requirements

The FHA loan guidelines are essentially the same for multi-family buildings as they are for single family residences. These are the basic requirements to purchasing a multi-family building with an FHA loan regardless of how many units you are buying or financing.

| Credit Score | 500 FICO or greater |

| Down Payment | 3.5% for FICO scores of 580 and above |

| Debt to Income Ratio | 43%-59.6% |

| Property Type | 2-4 Units |

| Property Use | Primary Residence Only |

| Citizenship | US Citizen |

*FHA Multifamily Guideline Chart

There are of course deeper requirements that we completely review in our article about FHA loan guidelines. What you may find different for multi-family loan approvals is as follows:

Rental Income – Some or all of the proposed rental income may be used in your DTI calculation when determining your eligibility or income requirements. Lenders may want to see copies of existing leases and they may also ask if you have prior experience managing rental properties. For first time home buyers, that answer will likely be “no”.

Primary Residence Status – If you already own a home, lenders will look hard at whether your true intent is to purchase the multi-family building as your primary residence. Especially if you are currently living in a single-family residence. Be prepared to answer questions about this.

FHA Self Sufficiency Test – If you are purchasing a 3-4 unit home, the income generated from the property must be more than enough to cover the mortgage payment. This could make purchasing a multi family home more challenging in some areas. Read more about the FHA self sufficiency test.

FHA Multi family Loan Pros and Cons

There are various advantages and disadvantages of purchasing a multi-family home with an FHA loan. These are just a few examples:

Pros

-

- Low down payment

- Lower closing costs

- Easier to qualify for than other loan types

- Lower credit scores accepted

Cons

-

- Mortgage insurance is required

- Loan limits by county

- Must be occupied as your primary residence for at least 1 year

Despite a few of the negatives referenced above, this really is a great mortgage program for first time home buyers.

FHA Multi Family Loan Limits

Every county has a specific loan limit set for 1-4 unit properties and the more units, the higher the loan limit will be. For most of the counties in the United States, the limits are the same. However, there are various counties which have been identified as “high cost areas” where the loan limits are much higher.

If you plan to purchase a home that cost much more than the FHA loan limit for your county, your down payment will have to be increased to make up for the difference.

Read our article on FHA loan limits where we go deeper into this and also provide a loan limit lookup tool where you can see exactly what the loan limits are in your area.

FHA Multi-Family Inspection

The FHA has established very specific inspection guidelines where every home or building must pass the inspection before the loan can close. The inspection is in place to protect both the home buyer and the lender from unforeseen expenses that could create financial hardship.

The inspections though are primarily in place to make sure the dwelling is safe for the home buyer. When it comes to multi-family buildings, they also need to be safe for the tenants you will eventually rent to. Any unsafe situations or hazards will be called out by the inspector and will need to be corrected prior to purchasing the home.

You can also expect FHA inspections for multi-family buildings to be more expensive than what you would pay for a single-family residence. When you think about it, there are multiple kitchens, bathrooms, electrical panels, appliances and more that need to be fully inspected. Ask your lender about rolling these closing costs into the loan.

FHA Multi-Family Appraisal

In addition to the inspection which is making sure things are safe and working properly, you will also need an appraisal. The appraisal establishes the market value to make sure you are not over-paying for the home. More importantly it protects the lender from providing a loan on a building that is not worth the value referenced on the sales contract.

Similar to the inspection, appraisals for multi-family buildings are also more expensive. Your lender can give you an idea as to how much it may cost. We will refrain from quoting prices here since those costs may vary based upon your location.

Keep in mind that the inspection and appraisal is performed by third parties and your lender has no influence on the costs.

FHA Multi-Family Reserve Requirements

All FHA loans will require cash reserves to be established before the loan closes. These reserves are to provide a small buffer or emergency fund in the event of an unforeseen occurrence in your life such as a job loss or medical expenses.

Reserves are the total dollars needed to cover your mortgage payment to include principal, interest, taxes, mortgage insurance and home owners insurance for one month. These are the standard reserve requirements:

- 2-unit – 1 month of reserves

- 3-2 units – 3 months reserves

If you are receiving gift funds from a relative, those also can be used to build up your reserves. If you believe you may need gift funds to help with your reserves, down payment or even closing costs, then read our article on FHA gift funds for more information.

Mixed Use Properties

You may purchase a mixed-use property with an FHA loan that is essentially a combination of residential and retail or commercial space. What is most important is for a minimum 51% of the total square footage of the building must be residential. This is because FHA loans are primarily for residential homes.

Commercial space is allowed if its use does not negatively impact the health and safety of the residential occupants. For example, if some of the space is being used for the production of spices, the smells cannot make the living conditions unbearable or unhealthy for the residents living in the building.

Rental Income Calculated into DTI

In some instances, lenders may allow you to use some or all of the proposed rental income as part of your gross monthly income when determining your DTI. The lender may also utilize the self-sufficiency rental income test as part of their analysis and approval process.

If the building is already occupied and rented, then getting copies of the lease agreements from the seller will go a long way to getting the rental income included in your DTI calculation.

If the building is new construction, then an appraiser would have to provide the lender with what the fair market value is in the area for rental income.

FHA 203k for Muti-Family Buildings

If the building needs some updating, then an FHA 203k loan may be a great option for you. This is especially true if some or all of the other units are currently vacant. It will give you a chance to quickly upgrade the units so you can ask for higher rent payments.

When a home or building is not in great shape, it is an excellent opportunity for you to purchase it at a reduced cost. Even with the costs to rehab the building added, you still may be buying it at a discount. Do not overlook abused properties in your search for a multi-family home.

If you would like to learn more, then read our article about how FHA 203k loans work.

Local Laws for Owning an Operating a Multi-Family Building

Remember that although there are specific guidelines outlined here for qualifying for an FHA loan for a multi-family building, as a landlord you still need to obey local laws.

Every community may have unique laws and rules tied to owning and operating rental properties. Before moving ahead with your purchase, it would be a good idea to visit with the local office governing these rules to fully understand what is required of you as a landlord in that town.

You also will need to know if there are or have been any building violations or issues of any kind. It is smart to check to see whether any permits were taken out on the building. Then, see if the permits align with all the repairs that the seller claims to have done over the years.

FHA Multi Family Lenders

Most lenders in the United States offer FHA loans for the purchase of a primary residence. However, not all lenders will finance a multi family home with an FHA loan.

FHA lenders have the ability to decide which programs they offer, which types of homes, and what credit scores they are willing to accept. These additional requirements or exclusions are often called lender overlays.

In our network of FHA lenders, we can help you to finance a multi family according to the FHA 2-4 unit guidelines. This includes using the rental income from the building towards the income calculation on the loan application.

Please complete this short form and someone will speak with you about your desire to purchase a multi family home.

Conclusion – FHA Multi Family Loan Options

Purchasing a multi family home with an FHA loan is a great way to start real estate investing with a small down payment. We would recommend speaking with one of our experienced FHA lenders before you begin looking at properties. That way, you will know exactly what your price range is. If you are selling a multi family building, it is important to also understand how to prepare that building to be FHA eligible.

Click to get a quick FHA rate quote with no credit pull

Owning and Managing a Multi Family Home

If you are a first time home buyer and have never owned a home before, starting with a multi family home is a serious first step. Not only will you have to deal with many home repairs, but also the tenants.

The tenants will call for repairs to items that likely cannot wait to be fixed. Are you handy enough to make the repairs yourself? If not, do you have enough money in reserves to pay someone else to perform the repairs? Something to consider is renting to a handyman who can manage these issues for you.

Next, you will need to have a process to collect the rent and also understand what your rights as a landlord are when the tenants do not pay. Will you have the ability to make the mortgage payments if your tenants don’t pay or get behind in the rent payments? Are you allowed to evict tenants based upon the laws in your area?

These are all things that you should think about and have a plan to solve for before shopping for a multi family home.

FAQ – FHA Multi Family Guidelines

How many units can you buy with an FHA loan?

You can purchase up to 4 units with an FHA loan. This includes buildings that also have commercial space.

Do you have to live in the multi family home?

FHA guidelines require borrowers to live in the home as their primary residence for at least one year if it is financed with an FHA loan.

Related Articles

FHA Loan for a Duplex – Read the very specific requirements about how to purchase a duplex using FHA financing.

FHA Credit Requirements – see what the credit requirements are to qualify for an FHA loan and what your options are if you have low credit scores.

FHA Mortgage Insurance Guidelines – Mortgage insurance is required for every FHA loan today. This needs to be factored into your budget if you are thinking about financing a multi family building with an FHA loan.

HUD’s Article On Multi Family Dwellings