FHA Seasoning Requirements

There are specific FHA seasoning requirements which may limit your ability to refinance or require you to wait before moving forward with an FHA refinance.

What is Loan Seasoning?

Loan seasoning is a requirement set by loan guidelines or lenders whereby a homeowner must wait a specified amount of time after the original purchase before the home can be refinanced.

FHA Streamline Refinance Seasoning

The FHA streamline refinance is a program which allows homeowners who have an FHA loan on their home to refinance with less paperwork and without an appraisal.

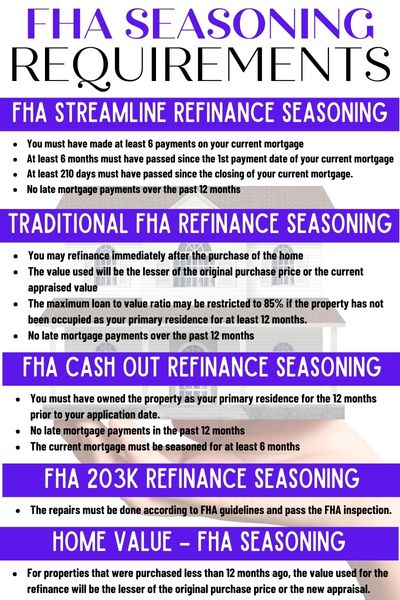

- The seasoning requirements for FHA streamline refinances are as follows:

- You must have made at least 6 payments on your current mortgage

- At least 6 months must have passed since the 1st payment date of your current mortgage

- At least 210 days must have passed since the closing of your current mortgage.

- No late mortgage payments over the past 12 months

If you have met the criteria above, then you can move ahead with an FHA streamline refinance. If you are close, then you can start the process now by completing this quote form to speak with someone.

Read [FHA Streamline Refinance Guidelines]

Traditional FHA Refinance Seasoning Requirements

If you are interested in applying for a traditional FHA refinance (not a streamline), the seasoning requirement will be as follows:

- You may refinance immediately after the purchase of the home

- The value used will be the lesser of the original purchase price or the current appraised value

- The maximum loan to value ratio may be restricted to 85% if the property has not been occupied as your primary residence for at least 12 months.

- No late mortgage payments over the past 12 months

This can sound confusing, but a good loan officer can help figure out what this means for you. You can read more about the FHA refinance requirements to see how you can qualify for an FHA loan.

FHA Cash Out Refinance Seasoning Requirements

A cash out refinance is a great way to pull equity out of your home to use for other purposes. If you are applying for a cash out refinance soon after the purchase of your home, this means the home appreciated in value quickly, you were able to buy the home well below market value, or you originally bought the home with a large down payment.

- These are the FHA cash out refinance seasoning requirements:

- You must have owned the property as your primary residence for the 12 months prior to your application date.

- No late mortgage payments in the past 12 months

- The current mortgage must be seasoned for at least 6 months (applicable if you had two mortgages over the past year)

For FHA cash out refinances, the largest loan amount cannot exceed 80% of the appraised value of the home. Read more about FHA cash out refinances to see how you can qualify.

FHA 203k Refinance Seasoning Requirements

The FHA 203k rehab loan is a great program which allows you to purchase or refinance a home while also borrowing the fund needed to update, repair or remodel the home. The repairs must also be done according to FHA guidelines and pass the FHA inspection.

If your current loan is an FHA 203k, it cannot be refinanced into a new FHA loan until all of the original repairs have been made and the FHA case number has been electronically closed out.

To learn more, read our article about FHA 203k Rehab loans.

Home Value – FHA Seasoning Requirements

For properties that were purchased less than 12 months ago, the value used for the refinance will be the lesser of the original purchase price or the new appraisal. This is an example of why cash out refinances will need to wait until after 12 months have passed.