FHA Streamline Refinance Requirements 2024

An FHA streamline refinance is a great way to refinance an existing FHA loan with less paperwork and without the need for an appraisal or income documentation. It is a hassle-free option for homeowners with an existing FHA loan who want to refinance their mortgage.

Qualifying for an FHA streamline refinance is easy provided you meet a few simple requirements.

Refinancing your FHA home loan will provide you with an opportunity to lower your interest rate as well as your monthly mortgage payments without documenting your income or having to meet credit requirements.

We have helped thousands of homeowners to refinance throughout the past two decades and will take you through all the features and benefits and the eligibility requirements of an FHA streamline refinance..

If you are ready to learn more, then click here to speak with a loan officer who can answer your questions and provide you with a rate quote.

What is an FHA Streamline Refinance Mortgage?

An FHA streamline refinance is a mortgage refinance program specifically designed for homeowners with existing FHA loans. It simplifies the refinancing process by reducing documentation and eligibility requirements compared to traditional refinancing options.

With FHA Streamline Refinance, homeowners can potentially lower their interest rate, pay off their loan faster, and even switch to a more predictable fixed-rate mortgage.

According to HUD’s FHA single family market share report, FHA refinances account for 11.23% of all refinance mortgages in the United States. They also indicate that the streamline version becomes most popular when interest rates are in decline.

5 FHA Streamline Refinance Qualification Requirements

These are the basic requirements when a lender determines your eligibility for an FHA streamline refinance:

1. The Current Mortgage Must Be an FHA Insured Loan

Only existing FHA mortgages can be refinanced with the streamline version of the FHA loan. If you have a mortgage that is not an FHA loan, then you can refinance to an FHA loan, but it cannot be an FHA streamline refinance. You would need to go through the full FHA application process with all of the required documentation and appraisal.

2. There Must Be a Net Tangible Benefit

The FHA guidelines define the net tangible benefit as a reduction in the interest rate, a reduction in the mortgage payment, or a positive change in the terms. If there is no significant savings for the borrower, then there is a chance the loan will not be approved. You may also increase the term from a 15yr loan to a 30yr loan if it helps to reduce your monthly payments. Changing from an adjustable rate to a fixed rate is also considered to be a benefit even if the payment increases.

3. The Existing FHA Loan Must Be Current

The existing FHA loan cannot have any late mortgage payments over the past three months. You may have one 30-day late payment over the past 12 months but your loan must not be past due at the time you are applying for a streamline refinance. You cannot refinance your FHA loan until you have made a minimum of 6 payments and 210 days have passed since the day of your closing.

4. You Cannot Increase Your Loan Amount to Cover Closing Costs

With an FHA streamline refinance, you cannot roll the closing costs into the loan. If you do not have the additional money for closing costs, you can negotiate with the lender to help pay for your closing costs.

5. Cash Out Refinances Are Not Permitted

You may not cash out equity with an FHA streamline refinance. The purpose of this loan is to lower your payments or the interest rate. The most you can walk away with at closing is $500 and that is likely due to any differences in closing costs.

FHA Streamline Refinance Loan Benefits

These are some of the great benefits of an FHA streamline refinance:

- No appraisal required

- No income documentation needed

- No debt to income calculation

- Home can never be underwater (loan amount greater than home value)

- Faster loan approvals and closings

- Lower rates than conventional loans.

- Annual cost savings by lowering the interest rate

It is for these reasons why this refinance program has become so popular. Read [FHA Streamline Refinance Benefits]

What is the Maximum Loan Amount with an FHA Streamline Refinance?

You are not permitted to cash out equity with a streamline refinance and we know you cannot borrow enough to cover ALL of the closing costs. However, here is what you are permitted to borrow:

Your current principal balance

PLUS – One month’s worth of prepaid interest

PLUS – The new net upfront mortgage insurance fee (minus any insurance refund from your current loan)

This is when you really need to think about the true net tangible benefit of refinancing. It won’t make sense to do it unless you can see a lower payment amount. If you see that interest rates have dropped since you purchased your home, then you may want to consider an FHA streamline refinance.

Streamline Refinancing Credit Score Requirements

The minimum credit score requirements for any type of FHA loan is 500. This is the same as what you would find if you were purchasing the home.

Not all lenders want to originate loans for individuals with scores that low and you do have lower credit scores, you may have difficulty refinancing. The lenders in our network all allow for credit scores down to 500.

For the FHA streamline refinance, lenders are instructed to pay less attention to the scores and focus solely on whether there are any late mortgage payments in the past 12 months referenced on your credit report. If you have been late paying your existing FHA loan, then getting an approval for any type of FHA loan will be extremely difficult.

FHA Income Verification and Program Requirements

One of the advantages of FHA streamline refinance is the simplified income verification process. Unlike traditional refinancing, which typically requires extensive documentation and proof of income, the FHA streamline refinance eliminates the need for income verification in most cases.

However, it’s important to note that you must still have stable income and be able to afford the new mortgage payments. The goal of the program is to reduce your payments or provide some other financial advantage.

FHA Mortgage Appraisal Requirements

FHA’s streamline program does not require an appraisal to verify the home’s value. This is extremely beneficial at a time where home values may have declined and there is no equity remaining in the home.

If the lender suspects there may be a serious issue with the home, they could still request an appraisal. For example, if they believe the home was recently burned in a fire or had significant flood damage, they could ask for an appraisal to be sure the home is in good condition.

Mortgage Insurance Premium and Refund When Refinancing

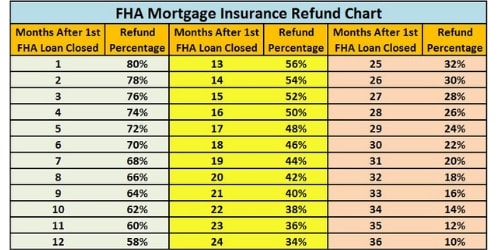

If you already paid an upfront mortgage insurance premium on your existing FHA loan, then you will be wondering why you need to pay for it again. It is true that you do have to pay for it once again for your refinance. However, you will get a pro-rated refund of what you paid initially. As a result, your new upfront mortgage insurance premium should be a lot lower than what you paid last time.

The FHA mortgage insurance premium refund is calculated on a pro-rated basis based upon how long you had your current FHA mortgage. The chart below shows you what you can expect in a refund at closing for what you originally paid in the upfront mortgage insurance premium.

For example, if your current mortgage is only 6 months old, you should expect to see a 70% refund in what you paid the first time. Pay close attention to the monthly mortgage insurance payment savings too. This is an added benefit that homeowners may realize if you have equity in your home.

Click to read more about FHA mortgage insurance premiums

FHA Closing Costs for Refinances

When you refinance using an FHA streamline loan, you will see some of the standard FHA closing costs that you dealt with when you purchased the home. There are a few exceptions though. The largest expenses are referenced below and likely will not be included in your refinance:

- No appraisal fee

- Mortgage insurance refunded amount

- Prepaid interest can be rolled into the loan amount

With these big ticket items essentially removed from your out of pocket closing costs, your cash needed at closing will be significantly less. Read our article about FHA closing costs so you can get an understanding as to what you can expect.

FHA Streamline Rates

One of the many benefits of an FHA loan is the fact that the rates are usually better than conventional mortgages. The same applies for FHA streamline refinance rates. You can expect the rates to be similar to the rates offered for FHA purchase loans.

When your lender determines your interest rate, they will take various factors into consideration. The most important factor is your credit score. The higher the FICO score, the better your rate will be. Keep in mind that once your score exceeds 720, there is no more benefit from a mortgage rate perspective. A score of 720 is essentially the same as a score of 800 when determining your rate.

If you are asking for your lender to cover the closing costs, then you should expect the rate to be slightly higher. It is a good idea to get a quote from one of our lenders where you pay for the closing costs, and one where they pay those costs. Then, you can see the payment difference and determine which is best for you long term

Click here to check on today’s FHA rates

Documents Needed for Your Refinance

The following documents are what every lender will ask you to provide:

- Your current FHA mortgage statement

- The current mortgage note showing the details of your loan

- The settlement HUD-1 documentation from your current loan

- Two months bank statements showing that you have enough money to settle at closing

- Contact information for your employer so the lender can verify your employment

- Copy of your homeowner’s insurance documentation proving you are insured

FHA Refinance Seasoning Requirements

FHA guidelines require the following for your existing FHA loan before you are eligible to apply for an FHA Streamline Refinance:

- Borrowers must have made at least 6 on time payments on their current FHA loan

- Borrowers must wait at least 6 months past the due date of the very first payment of the current FHA loan

- A minimum of at least 210 days must have passed from the closing date of the current FHA loan

When the language in the guidelines says you cannot “apply”, that application date is the day a new FHA case number is generated for your streamline refinance. You can start the initial process with a lender prior to that date. Read more about FHA seasoning requirements.

Expected Savings When Refinancing

If you ask lenders whether it makes sense for you to refinance, you may get multiple responses. What we tell our customers is that your monthly savings should cover the cost of refinancing in 24 months. Therefore, if your closing costs are $2,400, then it would make sense to refinance if your monthly payment or interest savings is at least $100 per month.

Depending upon how much equity you have in your home, the mortgage insurance portion of your monthly payment may also decrease. This is because the FHA mortgage insurance calculation is partly based upon your equity position in the home. As a result, you could realize a monthly cash savings that is greater than just the difference in your interest rate.

How Long Does an FHA Streamline Refinance Take?

One of the benefits of an FHA streamline refinance is less documentation and no appraisal. This will cut out much of the time versus what a traditional mortgage will take to close. Therefore the streamline version of the FHA loan can take as little as three weeks from the time of application until the day you close on your loan.

Summary of the Streamline Benefits and Whether it Makes Sense for You

If the interest rate on your current FHA loan is higher than the current market rates, then you should really consider an FHA streamline refinance. Without having the mountain of paperwork and income verification, it really makes refinancing much easier. Click to connect find an FHA lender in our network and they can review your options, provide a free rate quote, and help you to decide whether an FHA streamline refinance is right for you.

Frequently Asked Requirements and Benefits Questions

When you would not want to refinance with an FHA loan?

One reason why you may not want to go for an FHA streamline refinance is if your current loan balance is less than 80% of the home value. If that is the case, then you may want to consider refinancing into a conventional loan. That way, you would save quite a bit in mortgage insurance premiums. Our lenders can also help you with conventional loans.

Can I get an FHA streamline refinance if I don’t have an FHA loan now?

FHA streamline refinances are only available to individuals who currently have an FHA loan. If your existing mortgage is not an FHA loan, then you can refinance with an FHA insured mortgage but not a streamline FHA mortgage. You would need to provide all of the normal documentation, get an appraisal, etc

Can FHA streamline refinance closing costs be rolled into the loan?

Only one month’s interest, and the upfront mortgage insurance premium can be included in the loan amount. The good news is your closing costs should be lower anyway. For example, you will not have the cost of an appraisal.

Is there a no cost FHA streamline refinance lender?

There are lenders who will work with you to make sure you have no out of pocket costs with your FHA streamline refinance. However, they will likely charge you a higher rate in exchange for that. We can help you to find a lender who can provide you with a no cost streamline refinance.

Can I get an FHA streamline refinance if the home is worth less than when I purchased it?

You can refinance an FHA loan even if the home is worth less or under water. This is extremely helpful if you purchased the home at the height of the market and now want to refinance for a lower rate.

Can I cash out equity with an FHA streamline refinance?

You cannot cash out equity with an FHA streamline refinance. The program only allows for the refinance if the existing mortgage balance.

Is an FHA streamline refinance loan worth it?

If your monthly payment and interest rate is being reduced significantly, then an FHA streamline refinance is worth it. You should weigh the benefits and do the math before agreeing to any loan.

Can I qualify for a streamline refinance if I have bad credit?

FHA guidelines permit bad credit with scores as low as 500. However, many lenders will not accept scores that low.

Do I need to get a home appraisal to refinance?

Appraisals are not required for this type of mortgage which is extremely helpful if real estate values have declined.

Are there any upfront costs or fees associated with the refinance?

There should not be any upfront fees or costs associated with the refinance because there is no appraisal.

Can I include closing costs in my FHA streamline refinance loan?

Closing costs cannot be included in the refinance and must be funded out of pocket. However, you can negotiate with your lender to help cover closing costs in exchange for a slightly higher rate.

How much money can I save with a refinance?

The amount you can save each month will largely be determined by your loan amount and how much lower your rate will be.

Supporting Related Statistics

- Over 2.3 million homeowners have taken advantage FHA’s streamline program since its inception.

- The average interest rate reduction through this refinance is 0.75%.

- Approximately 90% of homeowners who qualify for the refinance choose to go through with the process.

- This FHA program has helped save homeowners over $7 billion in mortgage payments.

- On average, homeowners who complete the refinance experience a monthly savings of $250.

- More than 75% of the refinances are completed without requiring an appraisal.

- The average credit score of borrowers who successfully complete an FHA streamline refinance is 680.

- Homeowners who go through with the refinance typically see their loan-to-value ratio decrease by 5%.

- Approximately 85% of refinances are completed within 30 days from start to finish.

- Over the past five years, the number of streamlines have increased by 40%.

Related Articles

Can I Get an FHA Loan for a Second Home?

How to Get an FHA Loan With No Out of Pocket Funds

HUD Guidelines on FHA Streamline Refinances