FHA vs VA Loan

Two of the best and most popular government loans available consumer today are the FHA and VA loan programs. Combined, they account for at least 30% of all residential mortgages originated each year in the United States.

When comparing an FHA vs VA loan, you will find they both have unique features and benefits and depending upon your financial situation and eligibility, one program may be better for you than the other.

First, we will start by explaining a bit about each type of loan, their requirements and the differences between an FHA vs VA loan.

What is an FHA Loan?

An FHA loan is a mortgage that is provided by FHA approved lenders but is insured by the Federal Housing Administration (FHA). FHA loans were created to help borrowers who typically have a small down payment and/or poor credit. Home buyers who may not meet the criteria required for a Fannie Mae approval on a conventional loan often find they can purchase a home using an FHA loan.

What is a VA Loan?

A VA loan is one that is backed by the Department of Veteran Affairs (VA). Similar to FHA loans, VA approved lenders offer the mortgages to qualified applicants while the VA establishes the guidelines and insures the loans against default.

What are the FHA Loan Requirements?

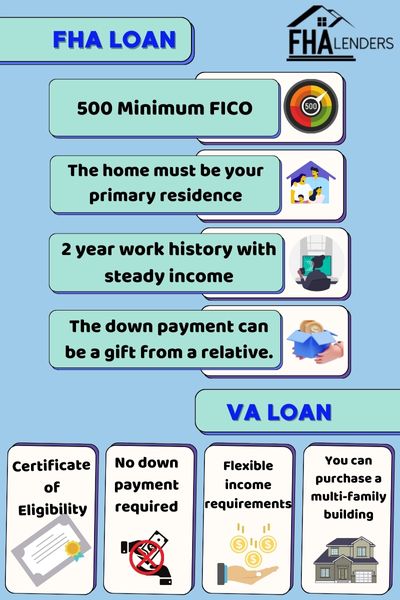

The FHA loan requirements are very flexible when it comes to qualifying, however the FHA has many rules that must be followed by FHA approved lenders before the loan can be funded. Here are the basic FHA loan requirements:

- Minimum FICO score requirement of 500 – down payment will vary

- Minimum down payment requirement of 3.5% – 10% with scores below 580

- Mortgage Insurance Premium (MIP) is required for every FHA loan

- Maximum debt to income ratio of 43%

- The home must be your primary residence

- The borrower must have a 2 year work history with steady income

If you can meet these basic requirements, you likely can get an FHA mortgage approval.

What are the VA Loan Requirements?

The VA loan requirements are strict when it comes to WHO can apply, but once you cleared that hurdle, qualifying for the mortgage is a bit easier.

- Applicant must be active military, retired veteran, in the reserves, or the spouse of someone who served.

- No down payment required

- Applicant must be employed for two years with an exception if you were serving in active duty

- DTI ratio not to exceed 41% preferred

- Applicants must pay a funding fee of 1.25% – 3.3% depending upon the down payment

- Lots of paperwork required

These are just some of the basic VA loan requirements. You can read more about VA loan eligibility and requirements here.

Additional FHA Loan Benefits

In addition to qualifying with a small down payment and low credit scores, here are some other benefits of an FHA loan.

- Sellers can contribute up to 6% of the loan towards closing costs

- FHA closing costs can be financed. Read our article on FHA closing costs can be rolled into the loan.

- The down payment can be a gift from a relative. Read our article on FHA gift funds guidelines.

- You can purchase the home and the funds needed to remodel with an FHA 203k loan

- FHA loans are available to anyone who is a US citizen and can meet the basic requirements

Additional VA Loan Benefits

The most obvious and most talked about VA loan benefit is the no down payment requirement. However, there are a few other benefits that you should also consider:

- No PMI or mortgage insurance

- Flexible income requirements

- Low interest rates

- No Prepayment penalties

- VA loans are assumable

- You can purchase a multi-family building

Differences Between an FHA vs VA Loan

Now that you have an understanding of what is needed to qualify for both an FHA vs VA loan, we will lay out the differences between them side by side below so you can visually make the comparison. See this FHA vs VA loan chart below.

| FHA Loan | VA Loan | |

| Down Payment Requirement | 3.5% | 0% |

| Credit Score Requirement | 500 | 620 |

| Maximum DTI Requirement | 43%-50% | 41% |

| Mortgage Insurance | Yes | No |

| Funding Fee | No | Yes |

| Pre-Payment Penalties | No | No |

| Assumable | Yes | Yes |

| Low Interest Rates | Yes | Yes |

| Loan Limits | Yes | Yes |

*FHA vs VA loan chart

Which is Better – FHA vs VA Loan?

When you weigh the features and benefits of an FHA vs VA loan, it looks like a VA loan is the better option of you are able to qualify using your military eligibility. The interest rates will be very similar but the true determining factor with these programs other than the down payment is the FHA mortgage insurance costs versus the FHA funding fee.

With an FHA loan, you have the FHA upfront mortgage insurance premium and also a monthly mortgage insurance payment for the life of the loan. VA loans do not have mortgage insurance but have the VA funding fee. That funding fee is a one time cost and over time, will cost much less than the FHA mortgage insurance.

The smart move would be to have some type of down payment on a VA loan to reduce the VA funding fee. That would help get the lowest cost possible.

FHA vs VA Interest Rates

When comparing FHA vs VA loans, the interest rates will be extremely competitive regardless of which loan you choose. This means the decision between the two loan programs will likely not be about the interest rate and more about which one has lower costs and which may permit you to qualify for a higher mortgage amount.

Where you may find a difference in rates is if the borrower has very low credit scores. In that situation, you may find one program could have lower rates than the other. There is no way to tell until you have completed the application process and your loan officer has analyzed the automated findings and reviewed rate options.

Refinance a VA Loan to FHA

If you have a VA loan, you can refinance to an FHA loan. The only program you cannot use is the FHA streamline refinance which requires your existing mortgage to be an FHA loan.

There would need to be a specific reason why someone would want to refinance out of a VA loan and into an FHA loan especially considering VA loans do not have mortgage insurance.

A situation where an FHA loan may be the better choice is if you are in a Chapter 13 bankruptcy. FHA loans permit a refinance while in a chapter 13 even if you have not been discharged yet. Read [FHA loan with a chapter 13 bankruptcy]

FHA vs VA Closing Costs

When you are buying or refinancing a home, most of the closing costs will be the same when looking at FHA vs VA loans. These would include appraisals, recording fees, title fees, etc.

The total closing costs may be lower when using a VA loan and the funding fee may be financed or rolled into the loan amount.

Frequently Asked Questions – FHA vs VA Loan

Can you use an FHA loan and a VA loan together?

This questions is often asked but no you cannot use these loans together. You can have an FHA loan on one home, and a VA loan on another, but you cannot combine an FHA and VA loan together on the same property.

Keep in mind that both programs require the home to be your primary residence. Therefore, you would finance your first home using one of these loan programs, then when you are ready for a new home one day you can use the other program while keeping your first home as a rental property.

Can Active Duty Use Both an FHA and VA Loan?

If you are currently an active duty military hero, you can use either an FHA or a VA loan to purchase or refinance your home. You are not required to use a VA loan.

Is a VA home loan worth it?

The answer to that will differ for each person. In our opinion, FHA loans are one of the best mortgage options and if you can qualify, it likely is worth it.

Do FHA and VA loans require an appraisal?

Both FHA and VA loans have appraisal requirements. In fact, the FHA appraisal guidelines are very strict to protect the borrower and the lender from future surprises that could significantly reduce the value of the home.

Are there Military FHA Loans?

There are no FHA loans that are specific to those who are in the military. However, military personnel are able to apply for an FHA loan if they prefer FHA vs VA.

Related Articles

How to Get an FHA Loan with No Money Down

Protecting your finances to get a mortgage