First Time Home Buyer Construction Loan Options

Many first time home buyers are looking to avoid buying an older home with some repair issues and are now focusing on building their dream home from the ground up.

A first time home buyer construction loan is perfect for those who can meet the requirements and have the time to work through the construction process with both the builder and the lender.

Click to speak with someone without a credit pull

Planning Your First Time Home Buyer Construction Project

As a first time home buyer, you have a few options on how to approach building your new home. You can purchase a lot first, then later find a loan for the construction portion of the process. We will also review the one time close construction loan option which allows you to purchase the lot and build the home with a single loan.

Selecting the Lot for Your New Home

You may already own the property where you plan to build. If not, then this may be the most important decision that you will make in the process. You can always change things in your home, but you can never change the location.

Take the time to research how large of a home you can build on the lot, what utilities are available, what the taxes are, if there are any hazards in the area, or if there is something about the lot that will make it unsuitable for a home.

Select a Builder for Your Construction Project

The builder is going to be extremely important and know that not all builders are the same. Find a reputable builder, check references, and do not rush this process. Selecting the wrong builder can lead to serious problems in the future and the potential for increases in costs before the end of the project.

Most lenders will want to approve the builder you are using. Therefore, do not sign a contract with the builder until you know you are able to use that builder with your mortgage.

To get an accurate estimate of what the build will cost, you will need to make all of the decisions up front regarding the finishes. Type of flooring, cabinets, windows, etc. If you are not specific about what you want, the builder will likely install basic lower quality materials.

Selecting a Construction Lender

Most lenders do not offer construction loans and they are not easy for a lender to execute. Take the time to find a lender who is very familiar with construction loans and one that has a team who help manage the process. If you need help finding a lender, then complete this form and someone will contact you to have a preliminary discussion and to answer questions.

If you need help managing the process, one of our lenders can help.

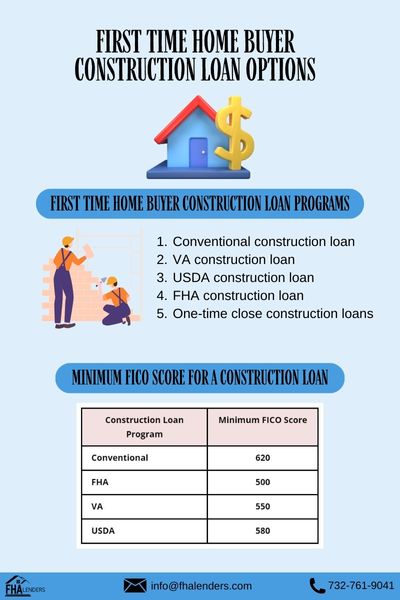

First Time Home Buyer Construction Loan Programs

As a first time home buyer, you do have a few construction loan options available to you when building a home. You may qualify for more than one of the loan options so we encourage you to explore and discuss them with a loan officer.

Conventional Construction Loan

When applying for a conventional construction loan, you have the option of a single closing transaction where your loan covers the cost of the build and remains in place after you move in as your permanent mortgage. Your other option is to finance the build separately and the convert the loan to a conventional mortgage.

Your down payment requirement for the conventional construction loan will be 20%. Long term, a conventional loan may be a better option because there will be no PMI with 20% down. However, most first time home buyers are not able to come up with that high of a down payment and still have money remaining to furnish the home and add personal touches.

VA Construction Loan

VA loans are for veterans and active military who have VA eligibility and who want to build their home. One of the benefits of a VA loan is the program is a zero down payment mortgage, and this can be extremely helpful when working on a limited budget.

If you are a veteran or active military and looking to build a home, contact us here to discuss your options.

USDA Construction Loan

USDA loans are for home located in a USDA designated rural area. They are also available in a construction loan version for individuals who are looking to build a primary residence.

USDA loans are also a 0% down program just like VA loans but you do not have to be in the military. There are also income limits meaning if you make too much, you likely will not qualify. If you are thinking about building a home in a rural area, contact us here to discuss your options.

FHA Construction Loan

The FHA construction loan is a one time close version which is discussed in greater detail below. With an FHA construction loan, you will need just 3.5% down and higher debt to income ratio tolerances.

The FHA version of the construction loan will allow you to pay for the lot, the build, all permits and most other expenses with your mortgage. Read more [FHA One Time Close Construction Loan]

One Time Close Construction Loans

Construction loans traditionally only covered the cost of the build and they were temporary loans that needed to be converted to a permanent loan once the build was completed.

The one time close construction loan is one mortgage that covers the purchase of the lot, the build and it is also the final mortgage that you will have while you are living in the home after the build.

Although the one time close construction loan is easy for first time home buyers, not all lenders offer them. You should spend as much time searching for the right lender as you spend finding the builder.

Minimum FICO Score for a Construction Loan

Home buyers are able to qualify for a construction loan with credit scores under 620. Especially using an FHA loan where the guidelines permit credit scores as low as 500.

| Construction Loan Program | Minimum FICO Score |

| Conventional | 620 |

| FHA | 500 |

| VA | 550 |

| USDA | 580 |

*minimum FICO score for a construction loan chart

What you will find is although the loan program guidelines allow for lower credit scores, most lenders who offer construction loans have a credit score overlay. This means they will ask for a higher credit score for the construction loan than what you may see in the chart above.

If you are looking to build a home and you have poor credit, your best bet is to focus on improving your scores before you begin the rest of the process.

Should I Find a Builder Before the Construction Lender?

We always recommend you discuss your options with a lender before speaking with a builder or a real estate agent. Knowing how much you qualify for and what lending options are available to you is something you must know before discussing your plan with anyone else. It helps establish a total budget between the purchase of the lot and the construction of the home.

How Does the Builder Get Paid with a Construction Loan?

When you have a construction loan, lenders are going to monitor the progress of your build and will release money as the construction progresses.

You will schedule a site inspection with the lender usually once per month. At that time, the lender will approve a payment based upon the completed portion of the build.

Some lenders will issue the payment to the borrower who will then pay the builder. In some situations, a lender may approve direct payments to the builder with the approval of the borrower.

In your contract with the builder, they will likely have a clause that talks about how frequently they will need to be paid. Make sure you secure a lien waiver from the builder at the time of payment. This is usually how construction loans work when it comes to paying the builder.

What Type of Home Can I Build?

Something to consider is that not all home types are accepted by construction lenders. The traditional stick built home is what lenders favor when approving the loan.

Some first time home buyers are looking to place a mobile home on their property. This usually means buying the home from a dealer, then installing it on the property. Make sure to check with your lender about mobile homes because they are not always accepted.

Other unique homes such as barndominiums, tiny homes, and other non-traditional types of homes may not be approved by the lender.

Summary

Building your home as a first time home buyer can be a reality if you plan carefully and work closely with a lender well in advance. The process will take time and there will be work on your part, but it will be well worth the effort when the home is completed and you move in.