Pennsylvania First Time Home Buyer Programs and Grants

Pennsylvania is a wonderful state to purchase a home and there are first time home buyer assistance programs and grants available for those who can qualify for one of the programs.

We are going to walk you through the various Pennsylvania first time home buyer programs. First we will share some information that may help you to decide whether buying a home in Pennsylvania is right for you.

Pennsylvania First Time Home Buyer Statistics

| Total Population | 12,964,056 |

| Number of Homes | 5,106,601 |

| Average Travel Time to Work | 27 minutes |

| Average Household Income | $63,627 |

| Total Number of Employer Locations | 302,015 |

Top 10 Cities in Pennsylvania by Population

| City | Population |

| Philadelphia | 1,619,355 |

| Pittsburgh | 302,425 |

| Allentown | 127,407 |

| Reading | 96,518 |

| Erie | 93,439 |

| Scranton | 76,376 |

| Bethlehem | 75,941 |

| Lancaster | 57,783 |

| Levittown | 52,643 |

| Harrisburg | 50,213 |

Top 10 Employers in Pennsylvania

- Aramark (Philadelphia) – 215,000 employees

- Comcast (Philadelphia) – 184,000 employees

- Communications Construction Group, LLC (West Chester) – 118,000 employees

- Universal Health Services (King of Prussia) – 87,000 employees

- Genesis HealthCare (Kennett Square) – 68,700 employees

- University of Pittsburgh Medical Center (Pittsburgh) – 53,171 employees

- Rite Aid (Camp Hill) – 53,100 employees

- The PNC Financial Services Group (Pittsburgh) – 52,906 employees

- First Commonwealth Bank (Indiana) – 51,800 employees

- Healthcare Services Group (Bensalem) – 48,900 employees

Top 10 School Districts in Pennsylvania

- Tredyffrin-Easttown Sd – Wayne

- Radnor Township Sd – Wayne

- Mt Lebanon Sd – Pittsburgh

- Haverford Township Sd – Havertown

- Upper Saint Clair Sd – Pittsburgh

- Pennridge Sd – Perkasie

- Seneca Valley Sd – Harmony

- Upper Dublin Sd – Maple Glen

- Peters Township Sd – Mcmurray

- Perkiomen Valley Sd – Collegeville

Pennsylvania First Time Home Buyer Mortgage Programs

There are various Pennsylvania first time home buyer mortgage program options. The most popular are conventional, FHA, USDA and VA. These are the basic requirements for each:

| Mortgage Program | Minimum Credit Score | Down Payment |

| Conventional | 3% | 620 |

| FHA | 3.5% / 10% | 580 / 500 |

| USDA | No Minimum | 0% |

| VA | No Minimum | 0% |

To see how much you can afford, use our home affordability calculator before shopping for a home.

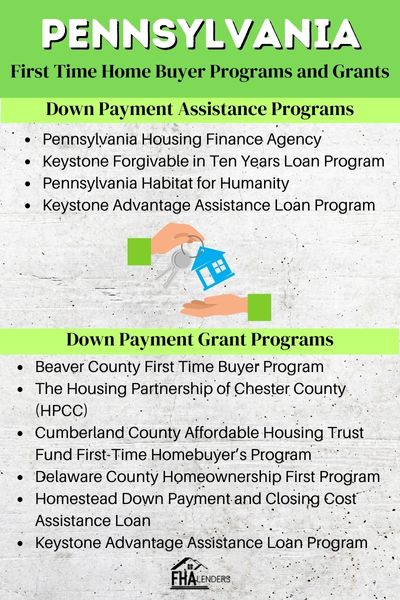

Pennsylvania Down Payment Assistance Programs and Grants

These are some of the most popular Pennsylvania down payment assistance programs and grants. Take time to research them to determine which one is best suited for you.

Keep in mind that for most down payment assistance programs, they will require you to be pre-approved by a lender. The first step is to complete this short form to begin your loan pre-approval process.

Pennsylvania Housing Finance Agency

The Pennsylvania housing finance agency provides both down payment and also closing cost assistance.

Here are the requirements:

- You must occupy the home as your primary residence

- The home must be located in PA

- All PAHAF eligible properties must be 1-4 unit homes, condos, or mobile homes

The PHFA Grant offers of $500 to help with down payment and closing costs.. The PHFA Grant of $500 does not have to be repaid but must be used when purchasing a home.

You may also combine this with the Keystone Advantage Assistance Loan Program.

Keystone Forgivable in Ten Years Loan Program

The Keystone Forgivable in Ten Years Loan Program (K-FIT) provide assistance with the down payment and closing costs. It is a second mortgage up to 5% of the purchase price to be used for down payment or closing costs.

It is a loan that is forgiven over the course of 10 years at 10% per year. If you sell the home prior to 10 years, you will owe the balance. This means if you sell the home after 5 years, you will owe the other half of the loan when you sell the home.

Requirements:

- You must have a minimum credit score of 660.

- Assistance can only be used for the down payment or closing costs, or both.

- The minimum loan amount is $500.

- Th program or funds may not be combined with any other PHFA assistance program.

- The program may be used on traditional loans such as Conventional, FHA, VA or USDA.

- To qualify, you cannot have more than $50,000 in liquid assets.

Pennsylvania Habitat for Humanity

The Habitat for Humanity program is one where volunteers will rehabilitate homes for low income families. There are minimum and maximum income limits that must be met for approval.

Income requirements and Limits – The minimum annual household income must be at least $24,000. The maximum household income is $48,400.

Credit Requirements – There is no specific credit score requirement, but you must demonstrate that your credit is improving and you need to be able to afford the mortgage payments plus any other debt.

The program provides and interest free mortgage through the habitat for humanity. You also must contribute at least 300 hours or sweat equity in the build of your home.

This program is not for everyone and it is for home that need to be build or rehabilitated.

Keystone Advantage Assistance Loan Program

The Keystone Advantage Program provides home buyers with a second mortgage to help cover the down payment and/or closing costs. The program is capped at 4% of the purchase price or $6,000, whichever is lower. These funds can be applied towards the down payment and closing costs.

You will need to go through a PHFA home buyer education program as part of the qualification process. The loan will be set at a zero percent interest and will need to be paid back over 10 years.

Down Payment Grant programs in Pennsylvania

These are some of the most common first time home buyer grant programs available in Pennsylvania.

Beaver County First Time Buyer Program

The Beaver County First Time Buyer Program provides assistance for both the down payment and closing costs for low to moderate income home buyers in Beaver County.

To qualify, you must be at or below 80% of the county’s median income. The amount available is determined by each borrowers needs and your liquid assets must be less than $5,000 at the time of closing.

The grant amount is forgiven over the course of 5 years. If you sell the home before 5 years, the prorated unused amount must be repaid at closing.

The Income Limits for the Beaver County First Time Home Buyer Program

1-person household: $47,500

2-person household: $54,300

3-person household: $61,100

4-person household: $67,850

5-person household: $73,300

6-person household: $78,750

7-person household: $84,150

8-person household: $89,600

The Housing Partnership of Chester County (HPCC)

The Housing Partnership of Chester County (HPCC) provides low to moderate income home buyers the assistance needed to purchase a home in Chester County.

The program provides home ownership counseling in addition to the funding. The assistance is a zero interest loan which cannot exceed $10,000 and the home must be located in Chester County. If you happen to purchase a home in the town of Coatesville, the assistance can be as much as $20,000.

Eligibility Requirements – All applicants must meet the following requirements:

- Be 18 years of age or older.

- Have a total gross household income at or below 80% of the median income, adjusted for household size. Liquid assets of borrower after closing cannot exceed $15,000.

- Intend to occupy the property being purchased as a primary residence.

- Be able to secure a 30 year, fixed rate mortgage from a local lending institution.

- Not have owned a home in the last 3 years or be a displaced homemaker.

- At least $1,000 towards the purchase of the home plus two (2) months reserves by

settlement.

Property Guidelines

Any home purchased must meet FHA guidelines for property requirements, inspections and loan limits.

Income Limits – These are the income limits for the program

- 1-person household: $54,150

- 2-person household: $61,850

- 3-person household: $69,600

- 4-person household: $77,300

- 5-person household: $83,500

- 6-person household: $89,700

- 7-person household: $95,900

- 8-person household: $102,050

Cumberland County Affordable Housing Trust Fund First-Time Homebuyer’s Program

The Cumberland County Affordable Housing Trust Fund First-Time Homebuyer’s Down Payment

and Closing Cost Assistance Program provides assistance up to $5,000 for first time home buyers in Cumberland County. You need to have lived in the county for at least six months prior to applying for the program.

You may qualify for up to $3,000 in assistance if the household gross household income is between 80% and 100% of the County’s Median Income. The funds can be used towards down payment and closing costs.

This program will match the buyers’ savings 3-to-1. This means the will donate $3 for every $1 of savings the buyer uses to

purchase their home. This assistance is in the form of a five year, no interest loan that does not have to be repaid.

Eligibility Requirements

All applicants must be first-time homebuyers and will have to provide documentation of their savings to qualify for the 3-1 match. The household liquid assets shall not exceed $30,000 after closing.

A pre-approval letter from a lender will be needed at the time of application for the program. The total gross annual household income cannot exceed the 100% median income guidelines as outlined below.

Income Limits

- 1-person household: $59,500

- 2-person household: $68,000

- 3-person household: $76,500

- 4-person household: $84,900

- 5-person household: $91,700

- 6-person household: $98,500

- 7-person household: $105,300

- 8-person household: $112,100

Delaware County Homeownership First Program

The Delaware County Homeownership First Program provides counseling in addition to down payment and closing cost assistance to eligible first time home buyers in Delaware County. The total amount of the assistance cannot exceed $5,000 and shall cover up to 2% of the down payment with the balance (if any) being applied towards closing costs.

Eligibility Requirements – Home buyers will be approved based upon their credit, income and assets. You must be a first time home buyer or have not owned a home over the past three years. You will need to contribute at least $1000 of your own funds towards the purchase.

Home buyers will need to complete an 8 hour first time home buyer counseling course.

Income Limits for the Program

- 1 person household: $39,200

- 2 person household: $44,800

- 3 person household: $50,400

- 4 person household: $56,000

- 5 person household: $60,500

- 6 person household: $64,950

- 7 person household: $69,450

- 8 person household: $73,900

Homestead Down Payment and Closing Cost Assistance Loan

The Pennsylvania Housing Finance Agency (PHFA) offers assistance to eligible first time home buyers. One of the assistance programs is the

Homestead Downpayment and Closing Cost Assistance Loan.

The program provides first time home buyers with up to $10,000 in down payment and closing cost assistance. It is a second mortgage to cover the costs at zero interest. The loan is forgiven over a prorated 5 years. If the home is sold before the 5 year mark, a portion of the loan must be repaid.

Eligibility Requirements

- Home buyers must meet the minimum down payment requirement based on the mortgage program they are applying for.

- Borrowers must meet the program income and purchase price limits for the county.

- The home must also meet other property guidelines outlined by the mortgage program.

Keystone Advantage Assistance Loan Program

The Pennsylvania Housing Finance Agency (PHFA) provides assistance to eligible first time home buyers. The program is a second mortgage to help with down payment and closing costs.

You can be approved for the lesser of 4% of the purchase price or $6,000. It is spread out over 10 years at zero percent interest and has monthly payments.

The Keystone assistance program can also be combined with other mortgage programs including the HFA Preferred (Lo MI), the HFA Preferred Risk Sharing (No MI), the Keystone Government Loan, or the Keystone Home loan (FHA, VA, or RD loan types only).

Eligibility Requirements

- There is a minimum credit score requirement of 660 for all applicants. The funds can only be used for the down payment and/or closing costs.

- There is also a cap of $50,000 in post closing liquid assets permitted for the borrowers.

- This program cannot be combined with any other PHFA assistance program.

This program provides funds to help with down payment and closing costs. Home buyers or borrowers must also meet all of the standard loan requirements for the loan program they are applying for.

Summary

There are many programs available to assist you in purchasing your first home in Pennsylvania. If you would like to speak with someone to get pre-approved for a mortgage first, then complete this short form.