W2 Only Mortgage Options

Many home buyers apply for a mortgage but only have W2’s for the past two years. It could be that tax returns were not filed or the IRS is behind in their processing.

You can get approved for a W2 only mortgage if you meet the basic criteria and if the automated underwriting system does not require copies of your tax returns to be provided.

What is a W2?

A W2 is a statement from your employer that shows how much you earned for the prior year, how much was withheld for taxes, healthcare coverage, and other benefits.

An employer must provide you with a copy of your W2 no later than January 31st and it must be included when you file your tax returns. It will also be required if you are applying for a mortgage. The IRS definition of a W2.

Get a Quote for a W2 Only Mortgage

Qualifying for a W2 Only Mortgage

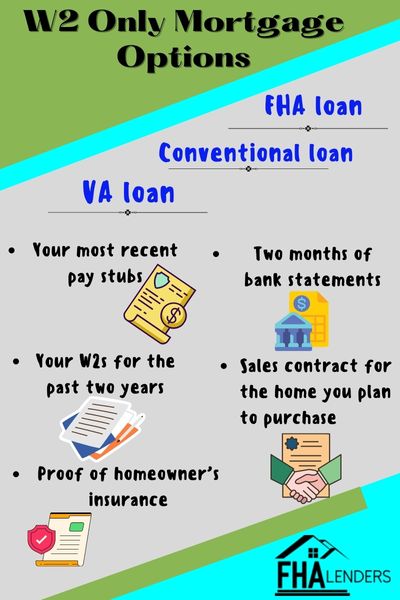

You may qualify for an FHA loan, conventional loan, or VA loan with just your W2s. The key element to this is whether the automated underwriting system (AUS) returns findings that your tax transcripts are needed as a condition of your approval. If the AUS does not require your tax returns, then you are able to just provide your W2s.

Aside from the W2s, you still need to qualify for the mortgage amount you are applying for. Each loan program will have different requirements. For example, with an FHA loan, you can have credit scores as low as 500, but for conventional loans you need at least 620

Your debt to income ratio will also be a factor when qualifying for a W2 only mortgage. With an FHA loan your debt to income ratio can be 56.9% while other mortgage options may limit you to a much lower percentage.

Regardless of which mortgage you are interested in, the requirements for an approval will be the same with the exception of having to provide copies of your tax returns or tax transcripts via the 4506-T form.

Mortgage with W2s Only with Bonus and Commission Income

If you have bonus or commission income that is less than 25% of your annual earned income, then you can apply with W2s only. If your bonus and/or commission income is 25% or more, then you will need to provide copies of your tax returns.

The lender or AUS will look at both bonus and commission combined to make the determination.

Credit Scores Needed for a W2 Only Mortgage

When applying for a W2 only mortgage, you may qualify with credit scores as low as 500. This would be an FHA loan accompanied with a 10% down payment. You can refinance though without having to provide a down payment of course.

Documents Needed for a W2 Only Mortgage

When applying for a mortgage with W2s, you will also need to have other documents. Be prepared to provide the following:

- Your most recent pay stubs

- Two months of bank statements

- Your W2s for the past two years

- Sales contract for the home you plan to purchase

- Proof of homeowner’s insurance

The bottom line is you will need to provide the standard documents that a lender would ask for.

W2 Only Mortgage Lenders

Most lenders will automatically ask you to provide copies of your tax returns because that is the standard process when collecting the typical documents needed.

However, if you are a W2 employee and can only provide W2s, then you will need to work with a lender who understands how to make this work for you.

If you would like to get pre-approved for a mortgage using just W2s, then complete this short form to start the conversation.

Other Helpful Articles

FHA Loan Requirements – everything you need to know about qualifying for an FHA loan

How to Get Pre-Approved for an FHA Loan