FHA Loan Limits for 2024

The goal of the Federal Housing Administration is to make sure home buyers can finance a modest home with the benefits of an FHA loan. FHA loan limits exist because FHA loans were not intended to be used to finance high priced luxury homes. Use our FHA loan limits lookup tool below to see what the loan limits are in your area.

FHA loan limits are the maximum amount an individual can borrow in each county within the United States using a Federal Housing Administration (FHA) loan

The FHA loan limit for 2024 increased to $498,257 for a single family home. In high cost areas, the new limit is now $1,089,300 for a single family home.

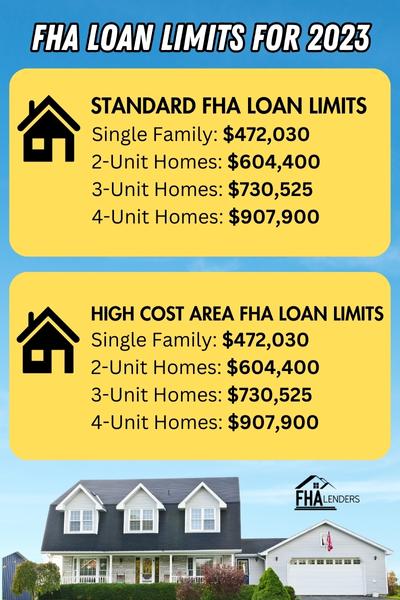

Standard FHA Loan Limits for 2024

These are the standard FHA loan limits for most counties in the United States. We recommend using the FHA loan limit lookup tool below to see if  the loan limits in your county are higher than the base limits referenced here.

the loan limits in your county are higher than the base limits referenced here.

Standard FHA Loan Limits

| Single Family | 2-Units | 3-Units | 4-Units |

| $498,257 | $637,950 | $771,125 | $958,350 |

FHA loan limits play a significant role in the US housing market. These limits, set by the Federal Housing Administration (FHA), determine the maximum loan amount borrowers can obtain for different types of properties.

FHA loan limits vary by state, county, and property type, ensuring flexibility in financing options. Understanding these limits is essential for homebuyers, particularly first-time buyers, as they provide opportunities for easier qualification and lower down payment requirements

FHA Loan Limits for High Cost Areas

The FHA recognizes that a moderately priced home will not cost the same everywhere in the United States. For example, a typical 3 bedroom home will likely cost 5 times as much in Southern California as it would in rural towns in middle America.

It is for this reason why the FHA has set specific loan limits for high cost areas in the United States. The base FHA loan limit in a high cost area for a single family residence is $1,089,300.

The FHA loan limits lookup tool below will let you know what the maximum loan amount is for an FHA loan in your county. The limits are higher for multi-family residences as they are for single family homes.

High Cost Area FHA Loan Limits

| Single Family | 2-Units | 3-Units | 4-Units |

| $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 |

FHA Loan Limits Lookup by County for 2024

The FHA loan limits vary for each county and are set to meet the average median home cost in each area. This FHA Loan limit listing below will be kept updated so you may bookmark the page for future reference.

Importance of FHA Loan Limits for Homebuyers in the US

Understanding FHA loan limits helps homebuyers to determine eligibility for FHA loans and plan their budget accordingly. These loan limits provide clarity on the maximum loan amount available in a specific area, allowing borrowers to assess their options and make informed decisions about purchasing a home.

FHA loan limits are typically more flexible than conventional loan limits, making homeownership more accessible to a wider range of individuals.

When the Purchase Price is Higher than the FHA Loan Limit

Many home buyers find themselves in a situation where the home price is much higher than the FHA loan limit for the county where the home is located.

In this situation, the home buyer must bridge the gap with a larger down payment to cover the difference. For example, if a home is selling for $650k but the FHA loan limit in the county is $500k, then the down payment must be at least $650k.

How do FHA Loan Limits Vary?

FHA loan limits can vary significantly across each state, county, and also property types. Factors such as the local housing market, cost of living, and demand for housing can influence these limits. Areas with higher costs of living and robust housing markets often have higher loan limits, while areas with lower costs of living tend to have lower limits.

How do FHA loan limits impact first-time homebuyers?

FHA loan limits can have a significant impact on first-time homebuyers, as they provide more flexible financing options compared to conventional loans. The lower credit score requirements and lower down payment options make it easier for first-time buyers to qualify for an FHA loan within the specified limits. This gives them the opportunity to enter the housing market with less financial burden.

Therefore, the higher the FHA loan limit, the better chance first time home buyers may qualify for a mortgage with a low down payment.

Why has the FHA Set Loan Limits?

FHA loan limits exist because the intent is not to fund the purchase of a luxury home with an FHA loan while making sure home buyers can finance a modest home in their county.

How Does the FHA Decide What the Loan Limits are?

The FHA reviews home sales data for each county in the 4th quarter of a given year. If they see median home sales have increased, they will proportionately increase the FHA loan limits for that county.

Why does the FHA increase the loan limits?

The loan limits are increased to make sure homeowners can afford an average priced home in their geography. If home prices continued to climb while the FHA loan limits remained the same, home buyers may not have the ability to afford homes in their local area.

Related Articles

FHA Mortgage Insurance Information

Official FHA Loan Limits Lookup Tool – same data as our tool