FHA Manual Underwriting Guidelines

If you are applying for an FHA loan, there is a chance that your application may need to be manually underwritten. FHA manual underwriting guidelines may require additional documentation or compensating factors to secure an approval.

If you believe you need to have manual underwriting for your FHA loan, the good news is there is a good chance you can still get approved for a mortgage.

The key to success when it comes to FHA manual underwriting is working with a loan officer who is experienced in working with difficult files. We have often seen one lender fail at securing a manual underwriting approval while others have great success. It comes with experience and preparing your loan package to the underwriter properly.

We can help you to get approved using manual underwriting. If you would like to speak with someone about your loan scenario, please complete this short form.

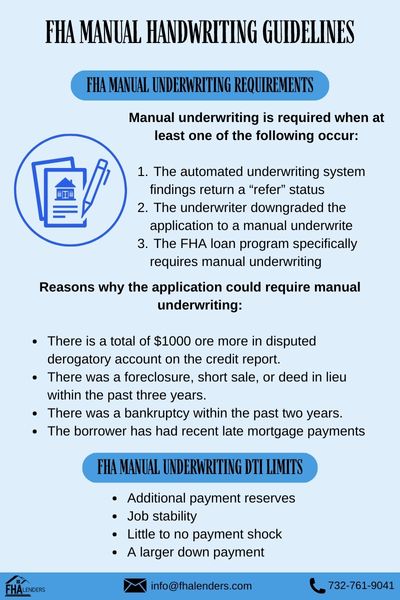

FHA Manual Underwriting Requirements

Manual underwriting is required when at least one of the following occur:

- The automated underwriting system findings return a “refer” status

- The underwriter downgraded the application to a manual underwrite

- The FHA loan program specifically requires manual underwriting

There are various reasons why the application could require manual underwriting. Some of these reasons may include one or more of the following:

- There is a total of $1000 ore more in disputed derogatory account on the credit report.

- There was a foreclosure, short sale, or deed in lieu within the past three years.

- There was a bankruptcy within the past two years.

- The borrower has had recent late mortgage payments

These are just a few examples and there could be other reasons why your FHA loan application would have to be manually underwritten.

What Will the FHA Manual Underwriter Look For?

The underwriter will be looking for things that can help to approve the loan in the areas of credit, income and assets.

Credit – The underwriter will look at a tri-merge credit report to inspect for dispute, collection or irregular credit activities. If there is not sufficient credit being reported, the underwriter may need to look at non-traditional credit to verify credit worthiness.

You should be prepared to provide explanations and help to remove disputes for various accounts. You may also be asked to pay for collection accounts to assist with your FHA loan approval.

If you have late mortgage payments, that will be difficult to overcome and your lender will instruct you on what you will need to do if you have multiple late payments in the past 12 months.

Income – When analyzing income, the underwriter will determine whether the income is legally derived, documented and likely to continue for the next three years. This will apply to borrowers who are salaried W2 wage earners and those who are self-employed. In addition to the income, the work history will also be reviewed.

Other income sources would need to be verified. These include alimony, child support, overtime, maternity leave, disability, bonuses, and 1099 income just to name a few.

Assets – FHA Manual underwriting guidelines require assets to come from acceptable sources as outlined within the FHA housing policy. The assets will need to cover the down payment, plus all closing costs and any reserves if required.

The underwriter will be looking for checking and savings accounts, gift funds, 401k accounts, down payment assistance, and any other acceptable source.

Final Underwriting – The underwriter must make decisions regarding the loan application that complies with HUD requirements. They will review the appraisal, credit, income and asset documentation to make a final decision on the approval.

The there are compensating factors, they will also be reviewed to help with the analysis.

FHA Manual Underwriting for Bankruptcies

If you have a recent bankruptcy, you may need to have your application manually underwritten for approval.

Chapter 7 Bankruptcy – If you are looking to have an exception to the two year waiting period after a Chapter 7 bankruptcy discharge, you will need to have your file manually underwritten. They will review your reason and any supporting documentation when determining whether an exception can be granted.

Chapter 13 Bankruptcy – You may have the ability to get approved for an FHA loan before your chapter 13 discharge, but after you have made at least 12 on time bankruptcy payments. This will also be manually underwritten.

Read [FHA loan after a bankruptcy]

FHA Manual Underwriting DTI Limits

The FHA loan requirements allow for higher DTI limits up to a maximum of 56.9%. As the DTI increases, the loan application may need to be manually underwritten.

In addition, the lender may also look for compensating factors with higher debt to income ratios especially when credit scores are lower.

Some of these compensating factors may include the following:

- Additional payment reserves

- Job stability

- Little to no payment shock

- A larger down payment

Read [FHA Debt to Income Ratio Requirements]

Summary

If you believe your loan may need FHA manual underwriting, then we can help you. It will be important to work closely with the loan officer, follow their direction, and provide whatever is needed to help with your loan approval.

If you would like to speak with someone about your scenario, please complete this short form and someone will contact you today.